Oct 21, 2021

Raw Sugar Gains on More Attractive Premium for Refiners

, Bloomberg News

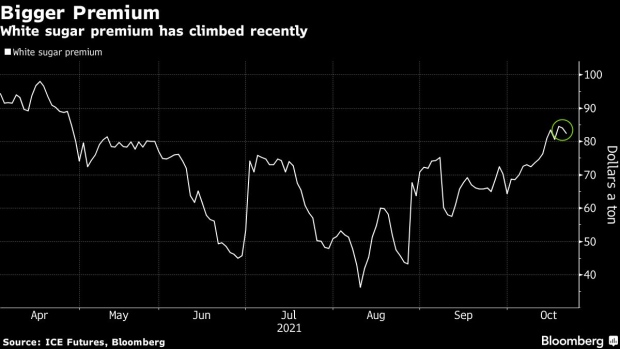

(Bloomberg) -- Sugar held gains from a two-month low in New York as a recent rally in the white-sugar premium makes it more attractive to refine raw supplies.

The premium that white sugar commands over raw futures this week reached the highest since April, potentially making it more profitable for factories to turn raws into refined sugar. The spread between March and May raw futures also in the past couple of days, which may signal stronger near-term demand.

“We’ve seen a bit more strength in the white premium recently and so should start to see some of the big re-export refiners come back to the market,” Ben Seed, an analyst at Czarnikow. “Because you’ve got a slightly stronger white premium, the market doesn’t necessarily need to pull back so much to start reconnecting with raw sugar demand.”

Raw sugar for March delivery rose 0.7% to 19.11 cents a pound. On Tuesday, prices had touched the lowest for a most-active contract since Aug. 10.

“Even if the market’s tumbles have come to an end, near-term prices look a little low,” Commonwealth Bank of Australia strategist Tobin Gorey wrote in a note.

In other soft commodities, arabica coffee extended gains and cocoa rose in New York.

©2021 Bloomberg L.P.