May 30, 2023

RBA Is in ‘Data-Dependent Mode,’ Lowe Says, as Inflation Jumps

, Bloomberg News

(Bloomberg) -- Australia’s central bank is in “data-dependent mode” when it comes to the prospects for further interest-rate increases, Governor Philip Lowe said, shortly before monthly data showed inflation heating up again.

Lowe, speaking to a panel of senators at Parliament House in Canberra on Wednesday, said that further rate hikes from the current 3.85% cash rate will depend on unit labor costs, the global economic outlook, inflation expectations and consumer spending.

He concluded his testimony 30 minutes before a report showed the monthly consumer price indicator rose 6.8% from a year earlier, up from 6.3% in March and faster than the forecast 6.4% gain.

Doubts over widespread expectations that the Reserve Bank would pause at Tuesday’s policy meeting sent the rate sensitive three-year government bond yield as high as 3.43% before trading at 3.392%. Stocks also extended declines.

“We’re in very much a data dependent mode,” Lowe told the senate committee. “We’ve increased interest rates a lot. Monetary policy is restrictive and it’s working.”

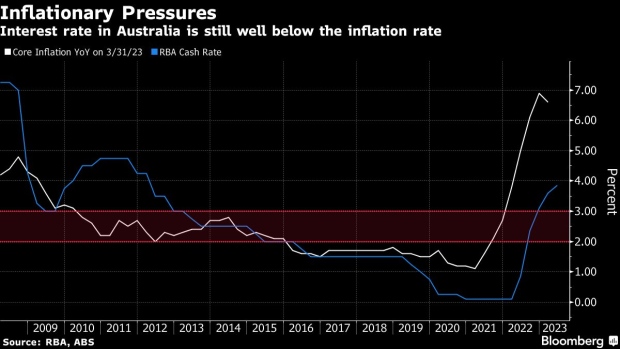

Earlier this month, the RBA unexpectedly hiked the cash rate to an 11-year high as the board worried about the risk of upside surprises to inflation from a tight labor market. The decision came as the central bank’s forecasts show inflation only returning to the top of its 2-3% target in mid-2025.

Today’s monthly inflation result was impacted by the end of a government fuel subsidy introduced in April 2022 that’s affecting the annual figure, the ABS said. After excluding volatile items, underlying inflation was 6.5% in April, down from 6.9% in March.

The report complicates Lowe’s task as the RBA board assesses the economy’s outlook following 11 rate hikes since May 2022 that have slowed consumer spending and employment growth, while business surveys are also pointing to weaker conditions.

“We’re not going to declare victory until victory’s achieved,” Lowe said on inflation. “We won’t be declaring victory prematurely.”

Today’s monthly CPI report showed:

- The most significant contributors to the annual increase were housing, up 8.9%, food and non-alcoholic beverages 7.9% higher, and transport, gaining 7.1%

- Automotive fuel prices were 9.5% higher in April 2023 than in April 2022, when prices fell following the 22 Australian cents per liter cut in the fuel excise, the bureau said

The RBA has raised rates by 3.75 percentage points over the past year and has signaled that it intends to keep moving cautiously, citing lags in policy transmission and a desire to engineer a soft landing in the economy.

“There are a lot of risks and they’re both to the upside and the downside,” Lowe said. “But given what we’re seeing internationally, I think the risks on inflation are more to the upside and we need to be attentive to that.”

(Adds monthly inflation data, chart.)

©2023 Bloomberg L.P.