Oct 6, 2022

RBA Sees Rising Financial Stability Risks on Higher Rates, CPI

, Bloomberg News

(Bloomberg) -- Australia’s financial stability risks have increased over recent months and some households and businesses are already facing “more challenging conditions” as interest rates rise and inflation accelerates, the Reserve Bank said.

“Household income growth has not kept pace with inflation,” the RBA said in its semi-annual Financial Stability Review released in Sydney Friday. “This has left households with less capacity to meet their rising housing costs -- loan payments or rent -- while maintaining their consumption and rate of saving.”

The RBA said it will closely monitor leading indicators of financial stress as risks mount for some vulnerable households, while acknowledging balance sheets are in “strong shape” overall.

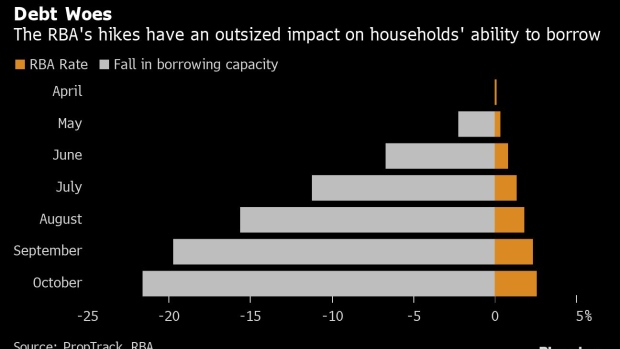

The central bank is in the midst of its most aggressive policy tightening in a generation, having delivered 2.5 percentage points of hikes since May. Governor Philip Lowe has signaled the need for further increases ahead in the struggle against inflation, even as he surprised markets by pivoting to a smaller hike this week.

The RBA’s tightening has already sent the property market sliding, with prices in bellwether Sydney falling for an eighth straight month in September. Economists predict the RBA’s cash rate will peak at around 3.2%, from 2.6% now, while money market pricing is slightly more aggressive at 3.6%.

Still, the RBA’s modeling shows the share of households at high risk of defaulting will likely remain low over the coming years, based on its central scenario for employment and income growth. If economic conditions deteriorated further than assumed, however, “a large share of households would be expected to fall into arrears on their mortgages,” it warned.

If interest rates rose to 3.6%, as implied by markets, just over half of variable-rate owner-occupier borrowers would see their spare cash flows decline by more than 20% over the next couple of years, the modeling shows. Around 15% of households would see their spare cash flows turn negative.

A majority of outstanding Australian mortgages are on variable loans with around 35% on fixed-rate terms, some two-thirds of which are due to expire by end-2023.

The RBA’s analysis shows most of these fixed-rate borrowers will face increases in borrowing costs of 3-4 percentage points when they roll over to variable rates, based on current market pricing.

Among other issues in the review of the financial system, the central bank found:

- The RBA’s securitization dataset shows, as at August, a little over 35% of all borrowers have prepayment buffers, equivalent to more than two years’ worth of minimum payments while almost one-quarter had buffers of between three months and two years

- For the median owner-occupier variable-rate borrower mortgage prepayment balances were sufficient to cover 20 months’ worth of required payments as at August, down from 22 months in April

- Australia’s financial system remains resilient and the country’s banks are well capitalized and loan arrears are low

- Cyber attacks could give rise to systemic risks, a point underscored by the recent attack on Optus

- Climate change and extreme weather events have the potential to affect economies and societies on a global scale, presenting a systemic challenge for private institutions and policymakers

©2022 Bloomberg L.P.