May 24, 2018

RBC, TD See Business Loans Surge as Mortgage Growth Plateaus

, Bloomberg News

(Bloomberg) -- A surge in business loans at Royal Bank of Canada and Toronto-Dominion Bank is helping lessen the sting of a mortgage slowdown.

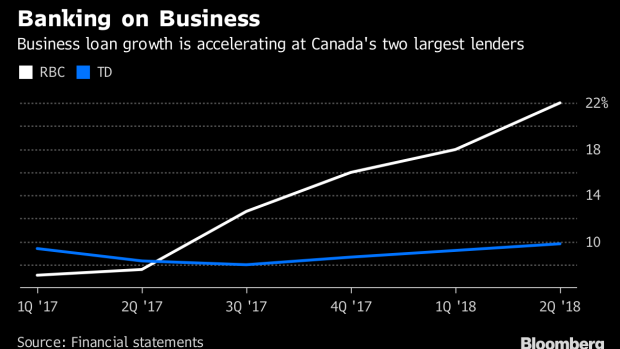

Royal Bank’s balances from business lending surged 22 percent to C$97.2 billion ($75.6 billion) in the fiscal second quarter from a year earlier, the Toronto-based lender said Thursday. Growth in that area, along with a 25 percent jump in wealth-management earnings, helped Royal Bank post profit that beat analysts’ estimates. Toronto-Dominion’s business loans rose 9.8 percent to C$71.8 billion.

“We maintained good momentum in the second quarter," Chief Executive Officer David McKay, 54, said in a statement. “Our businesses executed on client-focused growth strategies while continuing to demonstrate strong risk management."

Canadian business loans at Royal Bank have accelerated at a pace exceeding 12 percent since the second quarter of 2017, while domestic residential mortgages have hovered around 5 percent. Home loans comprise about 55 percent of Royal Bank’s total Canadian lending portfolio compared with 21 percent for business loans, though mortgages have tighter margins. Toronto-Dominion has seen at least six quarters of business loan growth above 8 percent.

Tougher Rules

"We’ve been quite focused on making sure that we have the best business bankers,” Toronto-Dominion Chief Financial Officer Riaz Ahmed said in a phone interview. “We have focused on a number of areas where we have been under-represented, including markets outside of Ontario, agriculture, dealer financing, leasing, etc."

Canadian banks have been anticipating a slowdown in home lending as tougher mortgage qualification rules, elevated housing prices and overextended borrowers weigh on demand.

Royal Bank said net income for the period ended April 30 rose 9 percent to C$3.06 billion, or C$2.06 a share, from C$2.81 billion, or C$1.85, a year earlier. Adjusted profit, which excludes some items, was C$2.10 a share, the bank said. That beat the C$2.05 average estimate of 14 analysts surveyed by Bloomberg.

Toronto-Dominion’s net income rose 17 percent to C$2.92 billion, or C$1.54 a share, from C$2.5 billion, or C$1.31, the lender said in a separate statement. Adjusted profit was C$1.62, exceeding the C$1.50 average estimate of 13 analysts surveyed by Bloomberg.

Canadian Imperial Bank of Commerce on Wednesday posted adjusted profit that exceeded analysts’ estimates, fueled by growth in its domestic business. Bank of Nova Scotia is scheduled to report results May 29, followed by Bank of Montreal and National Bank of Canada on May 30.

To contact the reporter on this story: Doug Alexander in Toronto at dalexander3@bloomberg.net

To contact the editors responsible for this story: Michael J. Moore at mmoore55@bloomberg.net, ;David Scanlan at dscanlan@bloomberg.net, Steven Crabill, Steve Dickson

©2018 Bloomberg L.P.