Jun 21, 2022

Recession-Fearing Bosses Quietly Abandon Open Jobs

, Bloomberg News

(Bloomberg) -- Companies that have struggled to fill job openings in the US for long stretches are starting to ask a pressing question: Do we really need those roles?

With interest rates soaring, stocks tanking and fears of a recession mounting, employers are axing jobs or dialing back their once-breakneck hiring plans. Amazon.com Inc. and Walmart Inc., America’s two biggest private employers, have said they’re thinning out their hourly workforces through attrition. Jobless claims, while still low, have risen slightly, based on a four-week moving average that smooths out weekly volatility.

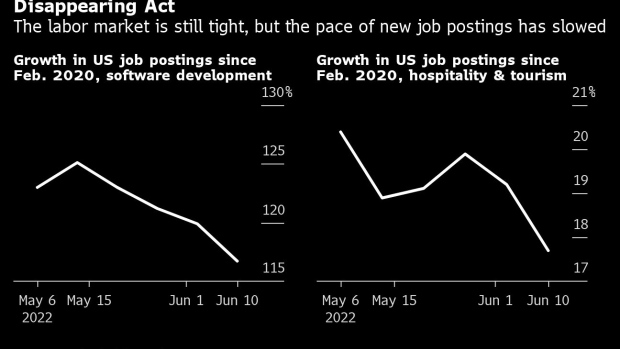

The pace of job postings has also slowed in recent weeks, according to data from career site Indeed, and not just in the hard-hit tech sector: Even hospitality job opportunities have decelerated, although they’re still above pre-pandemic levels. Those vacancies are staying unfilled for longer periods as increasingly skittish executives slow-walk the recruitment process. Reluctant to say they’re curtailing or even freezing hiring, companies instead couch their moves with corporate jargon like a “review of business processes.”

“They don’t want to talk about a hiring freeze, but what they are doing is adding an extra layer of scrutiny, like saying only the CEO can approve these jobs,” said David Vied, the global sector leader for medical devices and diagnostics at executive recruitment and consulting firm Korn Ferry. “There is this stealth slowdown.”

To be sure, plenty of jobs are available, and qualified candidates are in high demand in today’s tight labor market with openings still near record highs. But vacancies are staying unfilled longer, according to Greg Summers, North American president of recruitment firm Cielo, as it’s tougher to coax people out of their current jobs.

White-collar workers, keen to resign just months or even weeks ago for higher pay or a more flexible work arrangement, are now reassessing whether it’s worth jumping ship in choppier waters, according to recruitment experts.

“The balance of power is shifting,” Vied said. “There is this erosion of the power of the job candidate.”

More than six out of ten CEOs expect a recession before the end of next year in the region where their company primarily operates, and an additional 15% think a recession has already hit, according to a Conference Board survey of 750 CEOs and other C-suite executives conducted in mid-May. Since then, the benchmark S&P 500 has fallen further and the Federal Reserve last week raised interest rates by the most since 1994, with the expectation that inflation will cool and the US unemployment rate will rise to 4.1% by 2024, from 3.6% today.

Fed Chair Jerome Powell said last week that policy makers aren’t trying to “induce a recession now,” but that the “pathways” to overcoming inflation while maintaining a strong job market “have become much more challenging due to factors that are not under our control.” Powell’s critics, including Former Treasury Secretary Lawrence Summers, expect the jobless rate to go even higher.

Employers are getting caught in the middle of this macroeconomic mess, stuck with dozens of job openings they can’t fill while also wondering whether they actually need to fill them.

“Virtually every organization we work with has an absurd number of open job requisitions right now,” said Melissa Swift, the US transformation solutions leader at workplace consultant Mercer. “They sit around unfilled for very long periods of time. This is both a crisis, and an interesting indication that we simply might not need some of those jobs.”

©2022 Bloomberg L.P.