Apr 1, 2021

Record Green Bond Sales Greet BlackRock, Vanguard’s Climate Push

, Bloomberg News

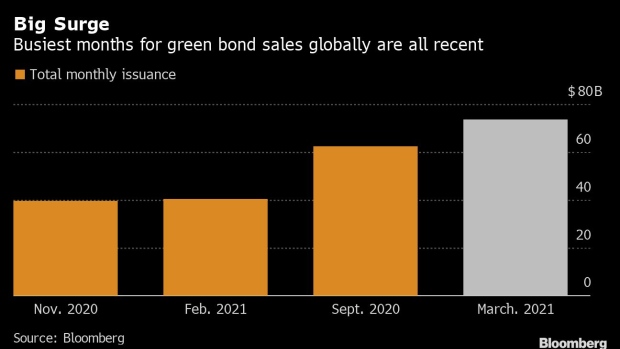

(Bloomberg) -- Debt sales to fund environmentally friendly projects set a monthly record in March, just as BlackRock Inc., Vanguard Group Inc. and other asset-management giants signaled a greater focus on battling climate change through their investments.

Issuers raised $73.4 billion from green bonds globally, beating the previous monthly all-time high of $62.3 billion set in September, according to data compiled by Bloomberg. First-quarter issuance amounted to $149.9 billion, up 186% from the same period in 2020.

Large investors are getting more vocal about supporting environmental, social and governance causes, meaning issuers have an increasingly receptive audience when raising money. This week, BlackRock and Vanguard joined the Net Zero Asset Managers initiative, a group of 43 firms with about $23 trillion in assets pledging to fight global warming.

“When asset managers with that kind of weight in the market make it clear that they are prioritizing a company’s greenhouse-gas trajectory, issuers have to take notice and green bonds are one of the important ways they can signal that climate commitment,” said Steven Nichols, head of ESG capital markets for the Americas at Bank of America Corp. “A green bond can distinguish those who are truly investing to improve environmental performance.”

Deals are getting bigger. Electric utility Clearway Energy Inc. issued $925 million of high-yield securities last month, the largest-ever junk green sale from a U.S. company. And President Joe Biden’s $2.25 trillion infrastructure plan presented Wednesday could keep the momentum going, fueling private-sector issuance of ESG bonds. Biden included $650 billion for initiatives such as cleaner water and high-speed broadband.

“The proposal’s focus on sustainability will also accelerate the green revolution, and we recommend that investors seek a diversified exposure across various sustainable asset classes,” Mark Haefele, UBS Global Wealth Management’s chief investment officer, said in a note Thursday.

There are, however, concerns about greenwashing, or the possibility that governments and companies exaggerate or misrepresent their environmental credentials or sustainability bona fides to tap feverish demand, lower borrowing costs and boost their reputation.

“Sustainability needs to be an authentic integrated strategy with milestones and an execution plan in place to reach a company’s long-term goals,” said Bridget Fawcett, global co-head of sustainability & corporate transitions at Citigroup Inc. “Investors are looking for transparency and keen to deploy capital to businesses that drive people, planet and profits in combination.”

©2021 Bloomberg L.P.