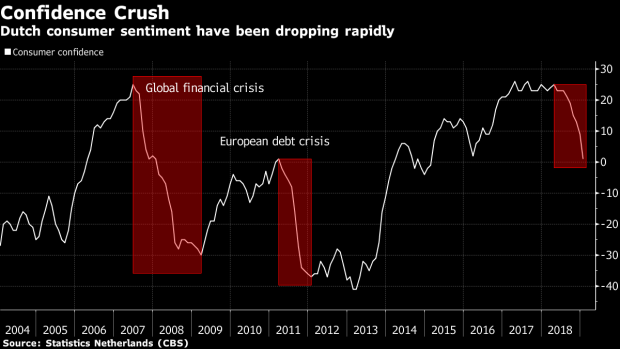

(Bloomberg) -- Dutch consumers have taken a sales-tax increase badly, sending their confidence plunging at the fastest pace since the European debt crisis.

A drop in sentiment in January dragged the index to the lowest in four years. The decline, while in line with weakness in sentiment seen across Europe, is in sharp contrast with other Dutch indicators: unemployment is falling and house prices are at a record high.

While external factors may be at play, such as market turmoil and a weaker euro zone, economists are partly blaming the slump on a sales-tax increase to 9 percent from 6 percent at the start of the year. The government also lowered income taxes, but the hike has contributed to a feeling among households that they’re getting squeezed and not fully benefiting from the economy’s strength.

That’s also a theme elsewhere, particularly in France, where French President Emmanuel Macron is under pressure from protests initially sparked by a planned tax increase. In Italy, the populist administration has pinned its colors to an anti-austerity regime aimed at helping the less well-off.

“People will see higher pay checks coming in this week, but most pay slips are quite complex, and the question is whether people compare them at all with the previous months,” said Nico Klene, senior economist at ABN Amro in Amsterdam. “On the contrary, seeing the costs of health insurance, energy bills and daily groceries rising may give consumers the feeling they’re worse off.”

--With assistance from Ellen Proper.

To contact the reporters on this story: Ruben Munsterman in Amsterdam at rmunsterman1@bloomberg.net;Fercan Yalinkilic in Istanbul at fyalinkilic@bloomberg.net

To contact the editors responsible for this story: Fergal O'Brien at fobrien@bloomberg.net, Zoe Schneeweiss

©2019 Bloomberg L.P.