Feb 6, 2021

Reddit mania overshadows outstanding earnings season for tech

, Bloomberg News

Reddit driven investing pushing democratization of financial structure: Michael Bucella

(Bloomberg) -- Anyone distracted by the Reddit-fueled circus in stocks this month may have missed an important fundamental story: A stellar earnings season for technology companies that helped the group’s shares outperform the market once again.

With more than half of S&P 500 earnings reports in the books, tech companies like Skyworks Solutions Inc. and Paypal Holdings Inc. are leading all of the other main sectors in the benchmark index with more than 95 per cent beating profit estimates, according to data compiled by Bloomberg. As for revenue, 88 per cent have topped estimates.

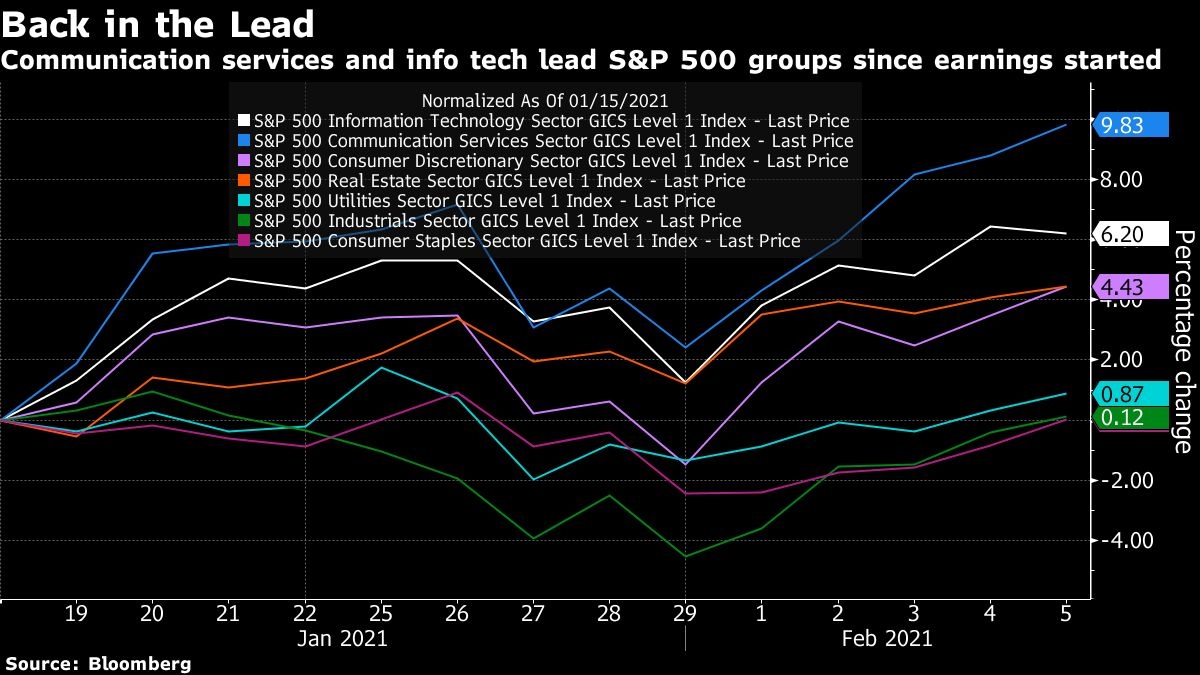

The strong showing has helped reignite gains for tech stocks after months in which the group lagged behind cyclical sectors like industrials that tend to benefit most in a rebounding economy. Since earnings season began on Jan. 15, the S&P 500 Information Technology Sector Index has gained 6.2 per cent, second only to the communication services group which includes tech giants like Alphabet Inc. and Facebook Inc.

“They had great earnings that you just can’t ignore,” Gary Bradshaw, a portfolio manager at Hodges Capital Management, said of technology companies. “This earnings season shows that they are going to continue to grow at a solid pace.”

Coming into 2021, technology stocks were expected by many to underperform relative to other industries poised for faster earnings growth. A key pillar of their strength last year -- the digital services and hardware that has been in such high demand during the Covid-19 pandemic -- would fall by the wayside as vaccines slowly brought normalcy back to the economy, or so the thinking went.

For now, the strong demand has shown few signs of abating. Wall Street has taken notice of the performance and raised earnings estimates after keeping them flat for months. Analysts now project 11 per cent profit growth in the fourth quarter, a four-fold increase from two weeks ago. Earnings estimates for the first three months of 2021 have jumped by 40 per cent since the beginning of January in the biggest advance among the 11 main industry groups, data compiled by Bloomberg Intelligence show.

One area of concern for bulls is lethargic stock reactions to good earnings reports from the biggest U.S. tech companies. Of the biggest five stocks in the market, Alphabet Inc. and Microsoft Corp. are the only companies whose shares are higher after their earnings reports. The Google-parent has gained 8.8 per cent since reporting revenue and earnings per share on Feb. 2 that beat the highest analyst estimates, while Microsoft has advanced 4.3 per cent since Jan. 26.

Despite beating estimates on nearly every metric, Apple is down 3.7 per cent since its report. Amazon.com Inc., whose revenue projections far exceeded analyst estimates, has fallen 0.8 per cent since its results on Feb. 2.

Sky-High Valuations

The muted investor enthusiasm is probably related to lofty valuations, relative to bargains in cyclical sectors and lurking antitrust risks, according to Jason Benowitz, a senior portfolio manager with Roosevelt Investment Group.

“These are formidable companies that are very profitable and can adapt to the environment and deliver for shareholders,” he said. “The things that hold them back on a relative basis are still out there and I’m not convinced that they’ll outperform in 2021.”

Some of the biggest surprises have come from chipmakers such as Skyworks Solutions and software companies like ServiceNow Inc. Both stocks have gained at least 12 per cent since releasing results.

Among companies reporting earnings in the coming week are networking giant Cisco Systems Inc., social-media company Twitter Inc. and online travel company Expedia Group Inc.

S&P 500 tech stocks are trading at 36 times reported profits, compared with less than 32 for the broader index. Concerns over potential regulation should make it harder for tech companies to keep outperforming, considering the premium they command with the group trading near the most-expensive valuation multiples in nearly two decades, according to Matt Maley, chief market strategist at Miller Tabak + Co.

“With the new administration, there is going to be a more diligent effort to pass some real regulation against some of these technology megacaps,” said Maley. “It’s not going to kill them and pop the bubble, but this could create a headwind, and that’s a real concern a lot of investors have. That’s one of the few things there is a bipartisan support on.”