May 7, 2021

Reflation, inflation, deflation: stocks can live with everything

, Bloomberg News

BNN Bloomberg's closing bell update: May 7, 2021

Markets are vulnerable to “significant declines” should risk appetites falter, the Federal Reserve has warned. At the moment, there are very few signs of that happening.

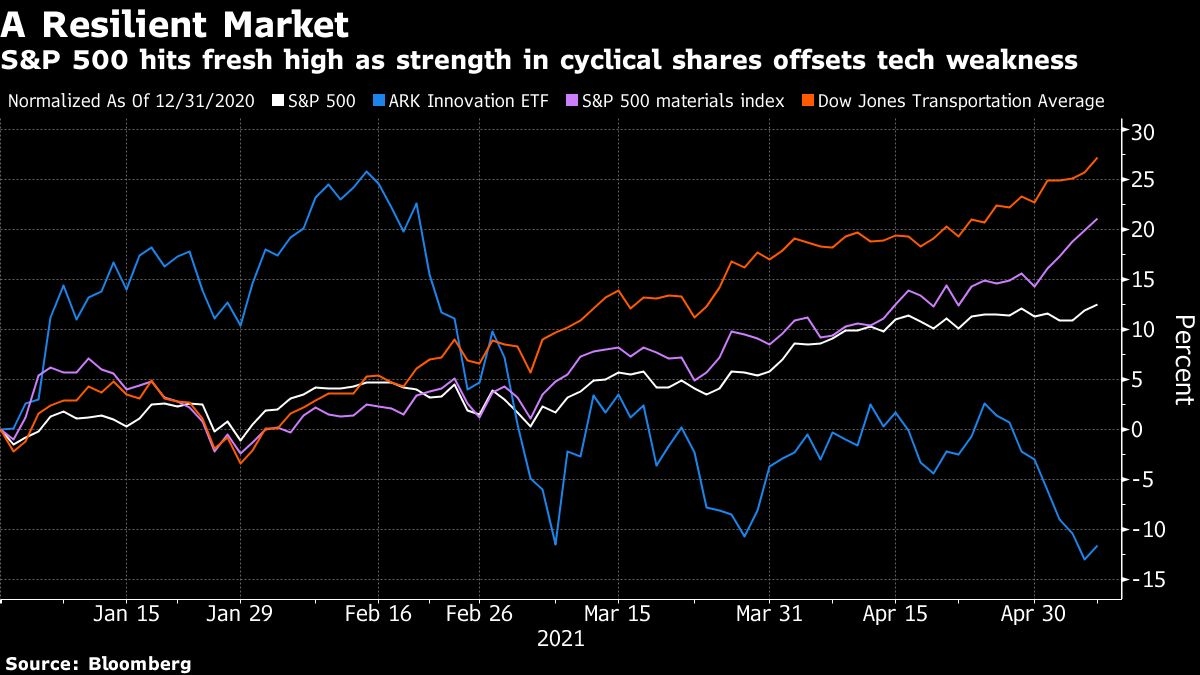

Stocks, in particular, seem able to shrug off any scenario the economy can spit out. Growth running hot? Banks and transports gain, as they did for all five days this week. Hiring hobbled? Big rebound in stay-at-home tech plays, like Friday’s in the Nasdaq 100 and Cathie Wood’s ARK Innovation ETF. Surging commodities sowing inflation angst? Buy materials makers, which just had their best week in six months.

“That is amazing. No matter what, we’ve seen the market predominantly go up, not down,” Susan Schmidt, head of U.S. equities at Aviva Investors, said by phone. “The market overall is still saying, we believe in the business recovery and we’re still betting on it.”

While the various twists have taken momentary tolls on all manner of peripheral indexes, they’ve all been virtual manna from the S&P 500, which just rose for its eighth week in 10 and is now up almost 13 per cent year-to-date. More impressive is the index’s resilience in the face of valuation measures that are by many metrics as rich as they’ve been since the dot-com bubble.

How precarious is the market’s altitude? Consider data from Leuthold Group, which compared prices today to their average levels since 1995, a starting point picked to correspond with a broad upward shift in valuations. When plotted against metrics like sales and earnings, the S&P 500 is at risk of falling 37 per cent, should a reversion to the mean occur.

Despite the drumbeat of bubble warnings, stocks march on. To skeptics, it’s a precarious perch riven with risks. Others simply see the persistent buoyancy underlining broad-based strength, allowing traders to find ways to stay invested as long as the economy holds up.

“The psychological and the behavioral part of the market is that animal spirits are incredibly powerful this year,” said Omar Aguilar, chief investment officer of passive equity and multi-asset strategies for Charles Schwab Investment Management. “The more people get vaccinated, the more they feel comfortable that things will plug forward and that is reflected in the market.”

With vaccines and policy support in place, consensus is building that the pandemic-ravaged economy will return to normal activity. What’s debatable is the pace of the recovery. The murky picture is pitting investors against each other, whipping up violent rotations among stocks.

The phenomenon was on display over the week. Richly-valued tech stocks sold off Tuesday after Treasury Secretary Janet Yellen said interest rates may have to rise moderately to keep the economy from overheating. Even though it’s a point she later walked back, traders took the cue from a surge in commodity prices, bidding up cyclical stocks.

That reflation narrative took a hit Friday, when hiring data significantly missed economist forecasts, casting doubt on the economic momentum. That sparked a rebound in the battered stay-at-home trade.

The back-and-forth between investment styles -- value versus growth, or cyclical versus defensive -- has been playing out all year. In some way, the split view on the trajectory of the economy is dividing the market like never before. Take a look at the relationship between the Russell 1000 value and growth indexes. Over the past six months, they have shown the lowest correlation on record. In other words, they’ve never been decoupled like this.

Professional investors have yet to fully embrace the reflation trade. Despite value’s outperformance this year, active funds still favor growth, according to data compiled by Bank of America strategists led by Savita Subramanian. They also avoid inflation beneficiaries such as energy and shun small-caps.

ETF traders, on the other hand, take an opposite approach. They have favored value strategies over growth every month in the past year, data compiled by Bloomberg Intelligence show. The biggest ETF tracking the Nasdaq 100 has experienced redemptions after US$1.7 billion of withdrawals in April, and is on course for its first back-to-back monthly outflows since early 2019.

Whatever the preference is, the prevailing inclination among investors is: stick to stocks. They poured money into U.S. equity funds in 12 of the past 13 weeks, according to EPFR Global Inc. data.

“As the world’s growth prospects recover and global growth improves, there are a lot of other places you can find companies growing earnings substantially and seeing a nice earnings recovery,” said Matt Miskin, co-chief investment strategist at John Hancock Investment Management. “That is where investors are dedicating their capital right now.”