Jul 26, 2021

Reflation trade’s last bright spot shines on in Canadian dollar

, Bloomberg News

I'd buy COVID dips in this market: Sevens Report Research's Tom Essaye

The Canadian dollar, one of the best-performing major currencies this year, may be poised to get a sustained second wind.

That’s in large part because many of the fundamentals -- elevated prices for raw materials and accommodative central bank policies -- that have buttressed the reflation trade this year remain intact even as jitters and stretched positioning have prompted some to pull back a bit from the currency. Many of these same dynamics are also undermining the yen, a key counterpart for the trade.

The loonie suffered setbacks over the past month as asset managers scaled back long reflation bets amid concern over surging virus cases from the delta variant. But speculators remained sanguine on the outlook, with leveraged funds increasing their holdings in the second week of July, data from the U.S. Commodity Futures Trading Commission show.

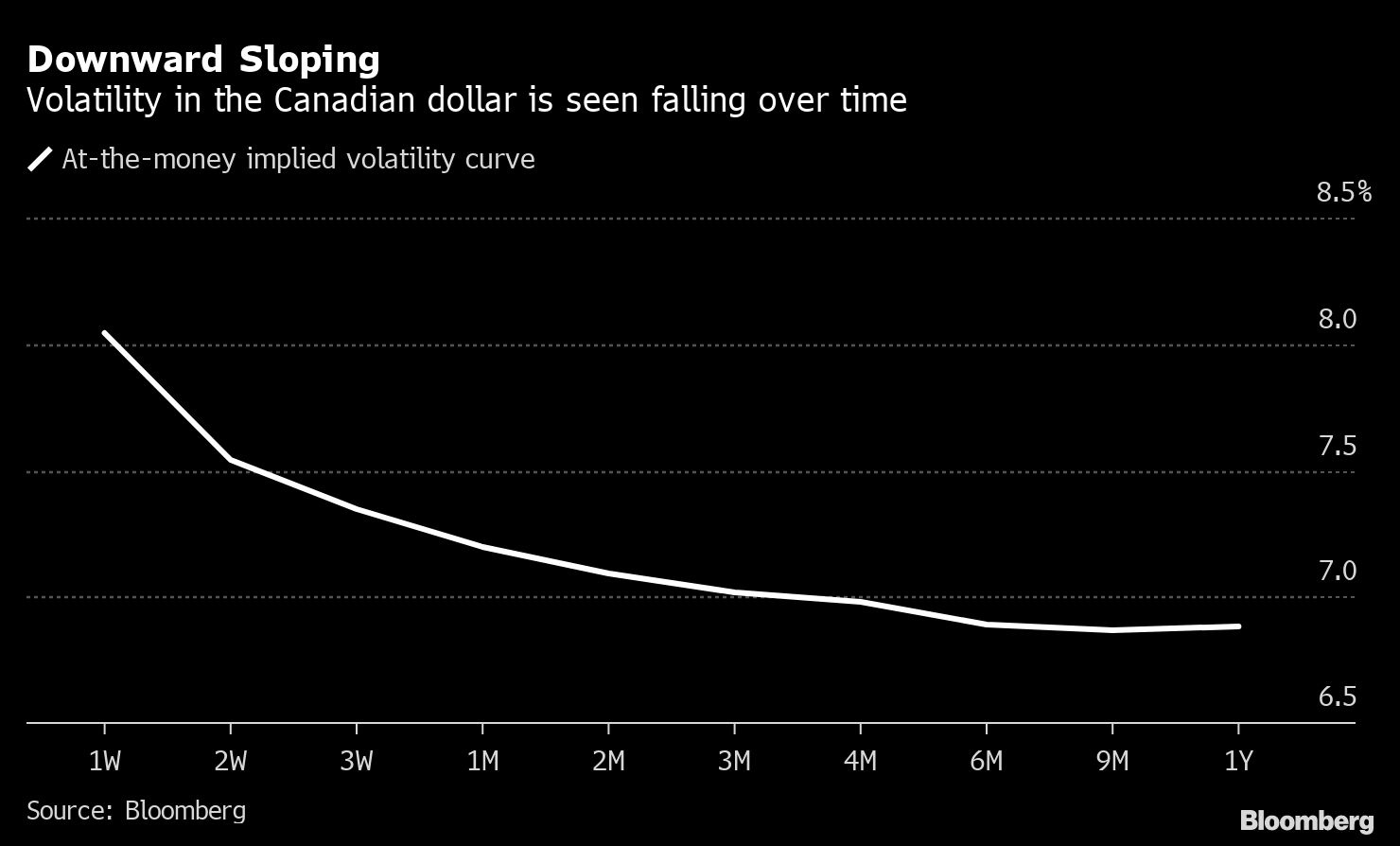

In the options market, while investors have hedged short-term event risks, the inverted shape of the currency’s volatility curve suggests they remain confident in the outlook that calm will prevail. And for those still upbeat about reflation, the Canadian dollar could prove to be a key part of the trading toolkit.

“Generally when the market doubts the global recovery, my inclination is to go the other way,” said Alan Ruskin, chief international strategist at Deutsche Bank. “The recovery is plainly being hurt by the delta variant especially in countries with low vaccination rates, but even allowing for this asynchronous recovery, the global economy in aggregate will remain robust.”

Ruskin is recommending a basket of the loonie, New Zealand dollar and Norwegian krone going long against the yen, “that is essentially consistent with the reflation trade.”

Commodity prices, after withstanding sharp setbacks over the past month, climbed to a fresh six-year high on Monday. The Canadian dollar’s sharp downturn in the past month, along with other resource-linked currencies, suggests upside potential in a return to the long-term trend.

On the flip side of the reflation trade, both speculative and real money accounts have been building short yen positions since January, reflecting a deteriorating terms of trade position for a country that imports resources. While asset managers scaled back bearish bets amid the recent market upheaval, they remain near the lowest level more than two years reached last month.

For traders that were long loonie-yen at the start of the year, they would be up more than 8 per cent this year as the Canadian currency is the best in the developed market and Japan’s is the worst.

CFTC data suggests speculative yen shorts may start fearing losses dollar-yen drops below 107 in the spot market, a level Japanese corporates are also sensitive to. Canadian dollar longs are watching $1.28 per greenback, a pivot point reached in December when positioning flipped bullish the loonie. Combining these levels for the loonie-yen pair equates to a cross rate of 83.50 yen per Canadian dollar, about 5 per cent below the current level of 88.

The loonie strengthened 0.2 per cent to $1.25 per dollar on Monday, while the yen traded around 110 against the greenback.

Long positions in the loonie and shorts in the yen are underpinned by expectations low real rates will keep monetary policy loose, stimulating economic recovery and boosting commodity prices. And while reflation bets, in general, have been under pressure since major central banks began signaling balance sheet tapering, recent comments suggest policy makers are likely to remain cautiously accommodative in the coming months.

Federal Reserve Chairman Jerome Powell told Congress this month that the U.S. economic recovery has not progressed enough to begin scaling back asset purchases. European Central Bank President Christine Lagarde pledged last week not to derail the recovery by tightening too soon.

While the backdrop remains supportive for the reflation trade, traders will have to be nimble should concerns like variant risks and soft economic data resurface, further pressuring the growth outlook. But for now, the options market and cash positions signal optimism, with shifts in terms of trade delineating between the winners and losers.

NOTE: Robert Fullem is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice.