Jul 9, 2021

Reign of FAANG oligarchy showing no signs of stock usurpation

, Bloomberg News

FANG stocks drive Nasdaq to new highs

A sudden swoon in bond yields has put the stock market “reflation trade” at risk of an early death. For all the ink spilled over the phenomenon, its list of lifetime achievements is short.

Yes, the rally that lifted banks and energy companies made headlines, buttressed hopes among value investors and was the basis for thousands of pages of Wall Street research. But its impact on the market’s overall contour has been slight, barely a blip when viewed on more than a monthly scale.

Consider its impact on the Faang bloc’s hegemony -- or lack thereof. Rather than loosen the grip of Facebook Inc., Amazon.com, Apple Inc., Microsoft Corp. and Alphabet Inc., reflation has been but a dent in their dominance of the S&P 500. As demonstrated again this week, the fate of those five firms is apt to matter more for the larger universe of index investors than all the reopening stocks combined.

“The S&P tech concentration has come down a bit since last summer, but if the Faang names are doing well, the market is doing well,” said Ross Mayfield, investment strategy analyst at Baird. “If you have the Faang stocks up more than 1 per cent on the day it’s going be hard for S&P to negative.”

After beating the S&P 500 for a seventh time in in eight weeks, tech stocks are resurrecting their leadership, offsetting losses elsewhere. While the Faang bloc’s 22 per cent representation in the benchmark is down a tad from last year, its influence on the S&P 500 remains greater than any comparable group of stocks since at least 1980, according to Goldman Sachs data.

Tech’s hefty share is again proving an hard-to-assail fortress. As Treasury yields screamed lower this week as peak growth concerns collided with delta variant fears, the sector largely held up. That helped the S&P 500 cling to a 0.4 per cent weekly gain, while the Nasdaq 100 ended the week 0.7 per cent higher. Meanwhile, the small-cap Russell 2000 sank 1.2 per cent.

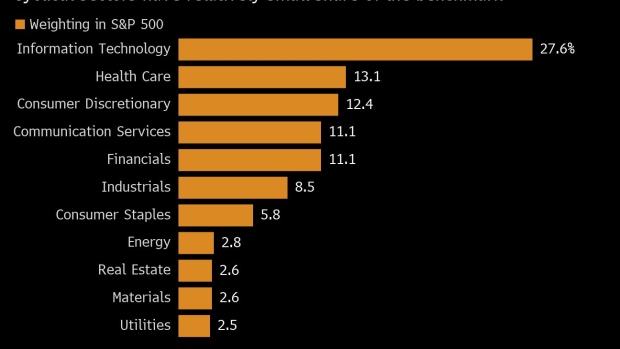

Given tech’s offset, the average index-hugging investor hasn’t had to worry about the reflation trade’s demise. The energy sector, which has surged nearly 40 per cent this year, makes up just 2.8 per cent of the benchmark. Financials, which are riding 24 per cent year-to-date gains, account for 11 per cent. Tech clocks in at nearly 28 per cent.

“For the market to make strides, you need participation from tech,” said Keith Lerner, chief market strategist at Truist Advisory Services. “When people talk about the reflation trade you have to think about the sector weightings, energy is 2-3 per cent, materials is 3 per cent -- energy can have a big move up but it’s less than 3 per cent versus tech is in the mid-20s.”

On a points-basis, despite all the noise around reopening stocks, it’s tech stalwarts such as Microsoft Corp., Alphabet Inc. and Amazon.com Inc. that have contributed the most to the S&P 500’s 16 per cent rally this year. While Marathon Oil Corp. is the biggest gainer with a 99 per cent surge in 2021, it’s only the 207th largest contributer to the benchmark’s performance, according to data compiled by Bloomberg.

That’s a blessing right now but not one without potential pitfalls. The Biden administration unveiled a wide-ranging executive order on Friday that would seek to lessen concentration in certain sectors, including technology.

“When you have five or six names making up that much of an index, what they do will matter,” Mayfield said. “On that front, the big thing to watch is what the administration here and abroad does about regulating big tech.”