Jun 4, 2019

Renault’s board weighs Fiat deal despite Nissan’s foot-dragging

, Bloomberg News

Potential Fiat-Renault merger could point to further auto sector consolidation: Manufacturers' association

Renault SA’s board pushed toward a vote on Fiat Chrysler Automobiles NV’s proposed merger despite failing to win over longtime partner Nissan Motor Co.

Directors of Renault are meeting outside Paris Tuesday to consider entering detailed discussions with the Italian-American automaker after Fiat proposed a deal. Prospects for an eventual combination may have improved after the French government and Fiat reached a compromise on state board representation, Reuters reported.

Renault’s path toward a deal was muddied after Nissan CEO Hiroto Saikawa said the company needs to review the future of their two-decade alliance, including contractual relationships, in light of Renault’s potential tie-up with Fiat. Renault directors nominated by Nissan are expected to abstain from the vote on backing further talks with Fiat, said people familiar with the information.

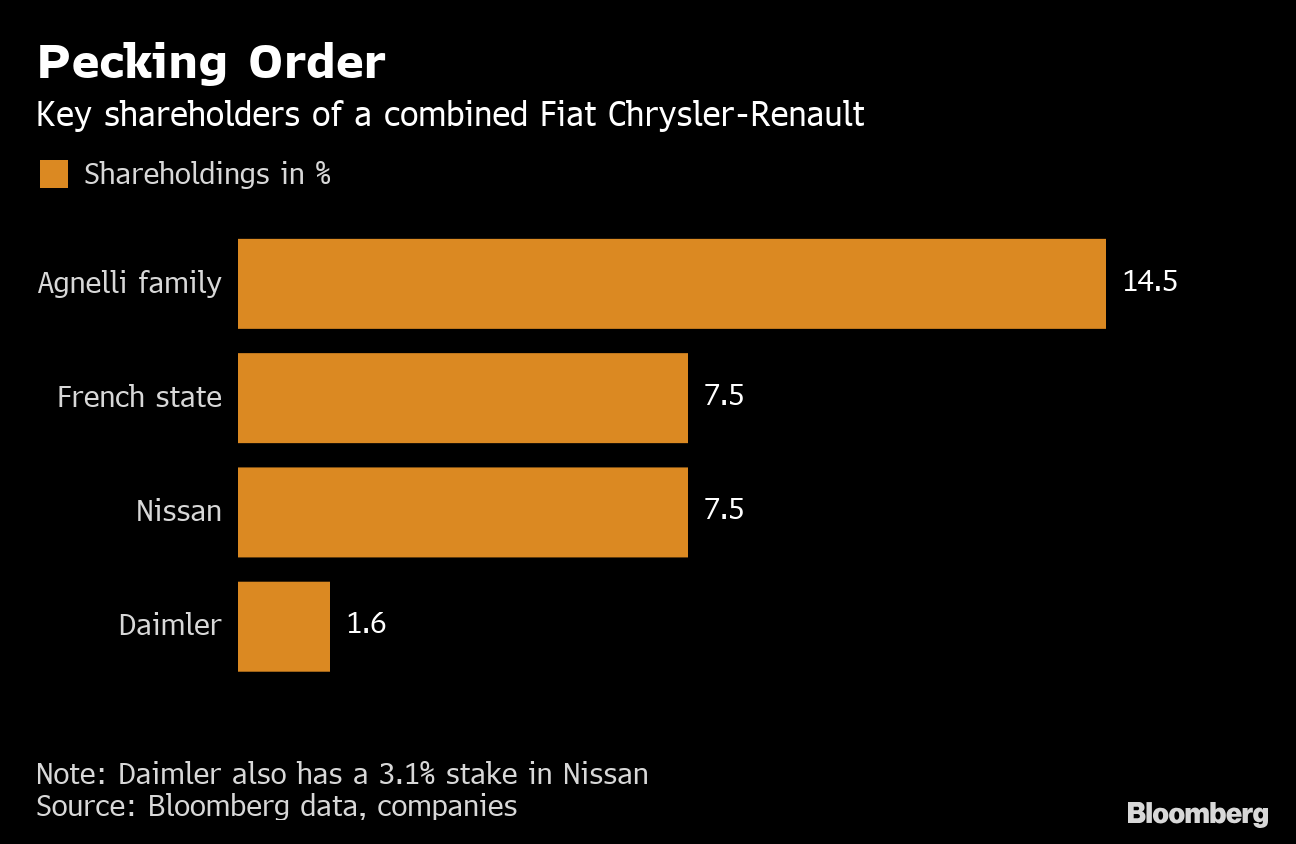

Fiat Chrysler’s proposal for a 50-50 Dutch holding company would create the world’s third-biggest car maker, adding scale to help the companies share costs and resources while tackling an expensive shift to electrification and autonomous driving. Shares of both Fiat and Renault climbed Tuesday.

While Nissan can’t block a Fiat-Renault combination, the Yokohama-based company could use its strong presence in China, Japan and the rest of Asia, as well as its electric-car technology, as leverage. French Finance Minister Bruno Le Maire has also said he wants any combination with Fiat to come within the framework of the Franco-Japanese alliance, which also includes Mitsubishi Motors Corp.

‘Fundamental Review’

“The potential addition of FCA as a new member of the alliance could expand the playing field for collaboration and create new opportunities for further synergies,” Saikawa said in his statement. “That said, the proposal currently being discussed is a full merger which — if realized — would significantly alter the structure of our partner Renault. This would require a fundamental review of the existing relationship between Nissan and Renault.”

The French government, Renault’s most powerful shareholder, wants additional guarantees from Fiat to avoid job cuts in France and other steps to protect national interests, people familiar with the matter have said.

France is also seeking operational headquarters of the combined company in Paris, and a special dividend for shareholders of Renault, which owns a 43% stake in Nissan, as well as a French government seat on the new company’s board, a finance ministry spokesman said.

Under the compromise reached with Fiat, the state would get one of four board seats allocated to Renault in the merged entity as well as one of Renault’s two positions on the CEO nominations committee, according to the Reuters report.

Representatives for the government declined to comment on the report, as did officials at Fiat and Renault.

The deal would benefit Fiat more than Renault, Paris-based activist investment manager CIAM said in a letter to Renault board members ahead of the vote. The French carmaker’s industrial assets have a negative implied value of 3 billion euros under the terms of the proposed deal. Based on earnings before interest and taxes, they should be valued at 6.75 billion euros, according to the Renault shareholder.

Under terms of the proposal, Renault shareholders including the French government, which owns a 15% stake, would get an implied premium of about 10%, while Fiat owners would get dividends to account for its higher equity value. Renault shares rose as much as 5.7% by 2:59 p.m. in Paris, while Fiat climbed 4.6% in Milan, giving the firms a combined market capitalization of about 34.6 billion euros ($38.9 billion).

The relationship between Renault and Nissan has been strained by the fallout from the arrest of their former chairman, Carlos Ghosn, in November. Mitsubishi Chairman Osamu Masuko has said he would need more time to determine the benefits, if any, for the Japanese automaker of the Renault-Fiat merger.

--With assistance from Kae Inoue, Reed Stevenson and Daniele Lepido.