Jan 27, 2021

Retail Mania Spurs Veteran Trader to Scour Chat Rooms and Charts

, Bloomberg News

(Bloomberg) -- The turmoil in parts of the U.S. stock market caused by the WallStreetBets crowd has prompted a veteran U.S. trader to ditch his old playbook built up over decades.

Larry Peruzzi, the head of international trading at Mischler Financial Group Inc. and a more than three-decade veteran of market action, said he’s spending less time looking at stock fundamentals and a lot more time on technicals and in chat rooms.

“We are currently looking a lot less at the balance sheets and a lot more at the chat rooms, trade quickly and avoid trying to use any valuation while trading,” Peruzzi said. “It doesn’t make sense, but in 2020/2021 would we expect anything less?”

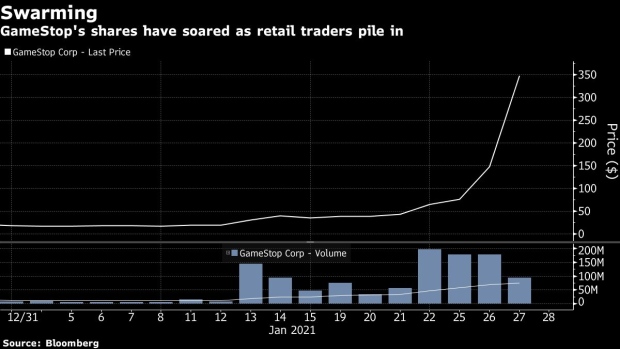

Markets have been upended in the past week as day traders swarmed over stocks like GameStop Corp. and AMC Entertainment Holdings Inc. in hopes of squeezing out short sellers. It’s worked: Melvin Capital closed out its short position and Citron Capital covered the majority of its short at a loss of 100%. That has the crowds at places like WallStreetBets newly confident, even if the activity is attracting attention from the likes of the Securities and Exchange Commission.

Historically, institutional investors tended to welcome retail traders because they added liquidity into the markets, Peruzzi said. But now it’s causing major trading and liquidity issues, and speculation is growing that funds could be forced to sell some holdings to meet margin calls, he added.

Read more: Cohen, Sundheim Lose Billions to Reddit Traders Running Amok

For now, there is a silver lining, at least for the companies whose stocks are being boosted by all the activity, Peruzzi said.

“Most of these firms are fallen angels and many are living on borrowed time,” he said. “The positive in all of this irrational trading is if these firms are able to act quickly, additional share offerings could give them the much needed capital to survive.”

©2021 Bloomberg L.P.