May 4, 2023

Return of Regional Bank Angst Batters Corporate Credit Markets

, Bloomberg News

(Bloomberg) -- Corporate credit investors are looking to reduce their exposure to risk and issuers are remaining mostly on the sidelines as concerns about regional lenders flare up again.

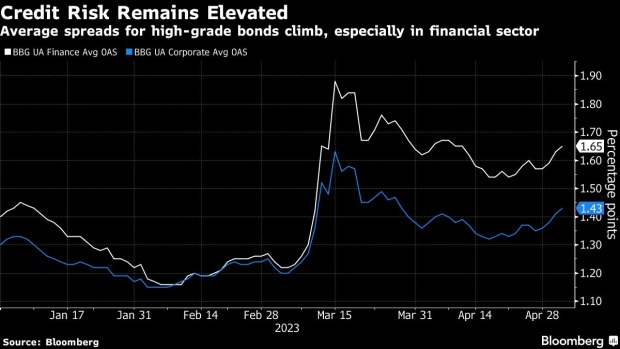

Blue-chip issuers largely avoided tapping the market on Thursday, while a key measure of credit risk soared to the highest since the failures of SVB Financial Group and Signature Bank in March. Angst is once again building about the health of the sector, even after involvement from the US government and banking behemoth JPMorgan Chase & Co.

Regional lenders including First Horizon Corp., Citizens Financial Group Inc. and Fifth Third Bancorp were among the worst performers in investment-grade secondary trading on Thursday. The shares of regional banks also fell.

“It still feels like we’re in March, unfortunately,” Bloomberg Intelligence bank analyst Arnold Kakuda said in an interview. “Even though these banks have talked about deposits stabilizing, it seems like the market is disregarding that.”

The investment-grade CDX, a key gauge of credit risk, climbed for a fourth-straight session to the highest since late March, when a string of regional bank failures had freshly spooked markets. The measure currently lingers below mid-March’s year-to-date peak.

Read: Regional Banks Shares Extend Rout as PacWest, Western Alliance Sink

“Market sentiment is poor for US regional bank bonds in markets today, capping off a tough week,” said Nicholas Elfner, co-head of research at Breckinridge Capital Advisors. “At this point, it is vital that banking regulators address financial instability and waning confidence.”

Just days after First Republic Bank was purchased by JPMorgan in a government-brokered deal, First Horizon said it and Toronto-Dominion Bank mutually agreed to terminate their merger agreement. First Horizon’s 5.75% bond due in 2030 plunged to the lowest price on record, falling as much as about 27 cents on the dollar to 68 cents before slightly paring losses, according to Trace data.

Representatives for First Horizon and Citizens Financial didn’t immediately comment. A spokesperson for Fifth Third didn’t immediately respond to request for comment.

While a few companies looked to sell new US high-grade bonds on Thursday, only one moved forward, according to an informal survey of debt underwriters. Boston Properties Inc. sold a $750 million green bond. A representative for Boston Properties didn’t immediately comment.

The chill across credit markets comes as investors assess the resilience of smaller lenders, which are facing the pinch as rising interest rates that lower the value of their longer-term investments while increasing the cost of funding. The Federal Reserve increased its key rate by another 25 basis points on Wednesday.

“The market would have wanted to see a bit more of a path forward in terms of cutting rates,” said Blair Shwedo, head of investment-grade trading at US Bancorp, in an interview. “It seems like the Fed wants to, at best, wait and observe and at worst, reevaluate hiking in a few months.”

--With assistance from Richard Annerquaye Abbey.

(Updates prices throughout.)

©2023 Bloomberg L.P.