Sep 15, 2022

Rick Stuchberry's Top Picks: September 15, 2022

BNN Bloomberg

Rick Stuchberry's Top Picks

Rick Stuchberry, senior portfolio manager, Wellington-Altus Private Wealth

FOCUS: North American large caps and global ADRs

MARKET OUTLOOK:

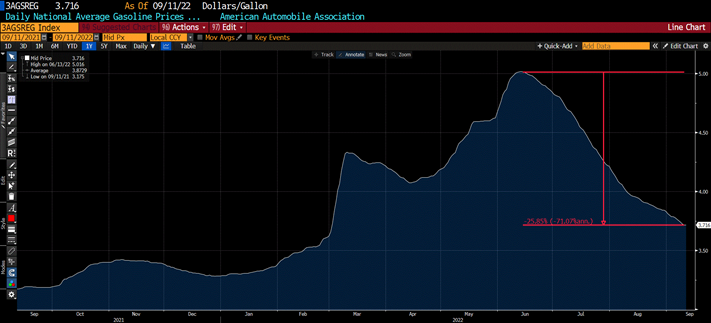

In July, we said that the markets wanted to know when this would be over and we think more evidence is emerging that things are improving. As more data comes in, it is getting easier to say that inflation topped in June. One indication to support this idea is that gasoline prices have declined by 25 per cent from the peak in June. See below.

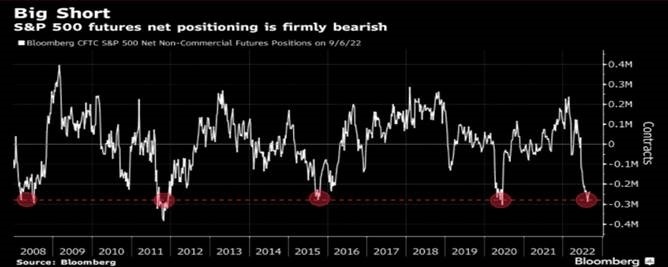

Notwithstanding the selloff after the poor inflation number on Tuesday, the markets are firmly above the June lows. This is meaningful, as it could mean that these lows could become the bottom level. We think one of the biggest risks in the market is that investors are waiting for a clear signal to buy versus investing while markets are soft, and stocks are on sale. Hypothetically, it’s entirely possible that if we got an amazing inflation number, we think the market could have gone up as much as it declined Tuesday, reinforcing the idea that the June lows could be the bottom.

Despite the negative market response to the August inflation number being at 8.3 per cent, the inflation situation is improving, albeit at a slow pace. Market participants, however, remain very bearish and are waiting for markets to go lower prior to committing capital. We think this is wrong and are trickling capital into the stock market. We have purchased good businesses, which have recovered slightly above average and provided great returns of capital to shareholders.

- Sign up for the Market Call Top Picks newsletter at bnnbloomberg.ca/subscribe

- Listen to the Market Call podcast on iHeart, or wherever you get your podcasts

TOP PICKS:

Home Depot has had very consistent earnings and dividend growth over the years. Its core earnings are growing at 7.6 per cent despite the 9.5 per cent inflation number in June. Home Depot is a consistent dividend grower that buys back its stock which further increases the earnings per share. Its dividend policy is to pay 55 per cent of the EPS, which has grown by roughly nine per cent year to date.

Microsoft is one of the world’s largest companies and a goliath through the ages, Microsoft continues to grow at a double-digit pace. Its annual share buyback at over $30 billion is larger than most companies and it has a history of hiking its dividend every year. We used the market weakness over the summer to add some Microsoft at a reasonable price.

ICICI Bank (IBN NYSE)

ICICI bank is a well-run Indian bank. Most of their revenue comes from traditional banking which is lower risk than non-interest income. They have a good return on equity and are in a great jurisdiction in India which has positive demographics, a growing GDP and rising global wealth.

PAST PICKS: July 7, 2022

Brookfield Renewable Partners (BEP.UN TSX)

- Then: $45.61

- Now: $50.22

- Return: 10%

- Total Return: 11%

Royal Bank of Canada (RY TSX)

- Then: $127.48

- Now: $127.84

- Return: 0.2%

- Total Return: 1%

Nvidia (NVDA NASD)

- Then: $158.58

- Now: $128.27

- Return: -19%

- Total Return: -19%

Total Return Average: -2%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| BEP.UN TSX | Y | Y | Y |

| RY TSX | Y | Y | Y |

| NVDA NASD | Y | Y | Y |