German Real Estate Firm Adler Reaches Agreement With Lenders

Troubled German real estate firm Adler Group SA has reached a non-binding agreement with bondholders, according to a company statement released on Thursday morning.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Troubled German real estate firm Adler Group SA has reached a non-binding agreement with bondholders, according to a company statement released on Thursday morning.

The deep freeze that’s gripped Europe’s real estate markets since borrowing costs jumped worsened at the start of the year as deals plunged to their lowest levels since 2011.

Investors are looking for the next policy domino to fall in Asia amid an escalating campaign against a resurgent dollar, after Indonesia used a surprise interest rate hike to defend the rupiah.

Vietnamese billionaire Pham Nhat Vuong pledged to invest at least another $1 billion of his personal wealth into VinFast Auto Ltd., providing the capital needed for expansion of the struggling electric vehicle maker.

Macrotech Developers Ltd., a real estate firm that operates under the brand name Lodha, expects pre-sales to grow about 20% in the year to March after reporting its highest ever quarterly revenue.

Feb 11, 2019

, Bloomberg News

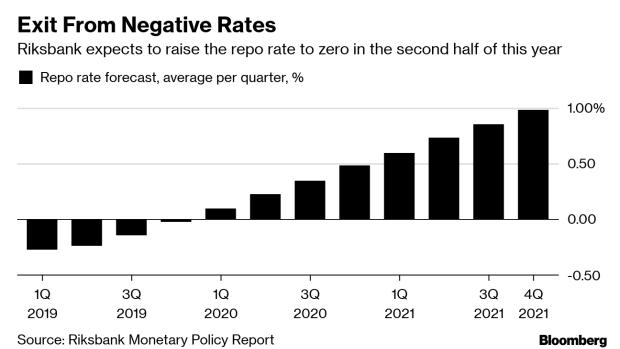

(Bloomberg) -- After raising interest rates late last year, Sweden’s central bank now has little choice other than to wait for a better economic outlook before pushing ahead with its long-awaited tightening cycle.

The December increase was the first in seven years, and brought the main rate to minus 0.25 percent. But already then, the Riksbank indicated the next increase won’t be until the second of half of this year. Anders Borg, a former finance minister, even suggests the Riksbank may need to wait longer, arguing in a recent interview that “autopilot is not a concept that should exist in monetary policy.”

Governor Stefan Ingves and his fellow board members have acknowledged that the economic challenges are growing. He has sought to reassure markets that the Riksbank will pay close attention to all the economic signals before doing anything.

For those reasons, the bank is expected to refrain from making any adjustments to its forward guidance as policy makers meet to discuss Swedish interest rates this week. Their talks take place against the backdrop of the Federal Reserve making a U-turn on its tightening cycle and as central bankers in Frankfurt and London have recently signaled more pessimism.

“By signaling a next rate hike in September, the Riksbank has given themselves some space to wait and see before potentially changing the guidance later,” said Torbjorn Isaksson, chief analyst at Nordea Bank Abp.

All 19 economists in Bloomberg’s survey expect the Riksbank to announce an unchanged repo rate on Feb. 13. The largest Nordic banks also anticipate no change in the forward guidance and that any decision on whether to extend bond purchases will be put off until April.

The Riksbank has sought to emphasize that it doesn’t want to slow down Sweden’s economy. Nevertheless, growth is cooling fast after a long economic boom. According to the latest forecast from the European Commission, Sweden will be among the EU’s slowest growing economies this year. High debt levels and sinking home prices are adding to the risks.

What the largest Nordic banks say:

To contact the reporter on this story: Amanda Billner in Stockholm at abillner@bloomberg.net

To contact the editors responsible for this story: Jonas Bergman at jbergman@bloomberg.net, Tasneem Hanfi Brögger

©2019 Bloomberg L.P.