Mar 31, 2023

Riksbank Pushes Back After ECB Remarks on Certificate Auctions

, Bloomberg News

(Bloomberg) -- A Riksbank deputy governor took issue with European Central Bank official Isabel Schnabel’s view that recent certificate auctions by the Swedes suggest challenges in steering short-term interest rates.

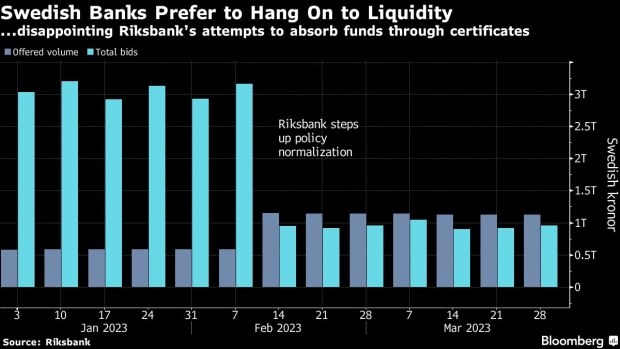

Since Stockholm-based policymakers started trying in February to remove all excess liquidity from the banking system by increasing issuance volumes, banks kept as much as 20% of funds in overnight deposits rather than investing the money in higher-yielding central-bank securities.

“We are satisfied with how this has played out so far,” Deputy Governor Aino Bunge said in an interview on Friday. “We hadn’t expected that the uptake would be 100%, and are pleased with the development.”

In a speech earlier this week, Schnabel, the ECB official in charge of markets, highlighted how the short-term SWESTR rate remains stuck near the Riksbank’s 2.9% deposit rate.

That doesn’t indicate that the measure hasn’t fulfilled its purpose, according to Bunge.

“Monetary policy transmission goes via various rates,” she said. “I don’t see it as a failure that SWESTR is at a level that is still very close to the deposit rate.”

The ECB is reviewing its own strategy, with conclusions due by the end of the year. Schnabel is wondering if the Bank of England’s approach of allowing banks to determine how much liquidity they want to hold may be a good fit for the euro zone.

--With assistance from Jana Randow.

©2023 Bloomberg L.P.