Feb 26, 2021

Risk-Parity Quants Hammered by Stocks and Bonds Moving Together

, Bloomberg News

(Bloomberg) -- One of the ugliest things about this week’s selloff is that there are so few places to hide, and that’s bad news for a breed of quant which seeks to spread out risk across assets.

So-called risk-parity strategies posted their worst day in four months on Thursday, according to an S&P index, while the $1.2 billion RPAR Risk Parity ETF plunged the most since the depths of the Covid rout in March.

The investing style made famous by Ray Dalio allocates money across assets based on their volatility, so can struggle when things go haywire together. Thursday saw the S&P 500 slump 2.5% as benchmark U.S. Treasuries tumbled, the latest in a series of co-movements that have taken the 60-day correlation between their futures to the highest since 2016.

Those moves are occurring in large part because investors believe rising inflation could erode the value of both assets. Such concerns look set to grow as the U.S. pushes through a $1.9 trillion stimulus and economies worldwide re-open with the pandemic easing.

For some, this will all bring back a familiar fear: As gyrations in both bonds and stocks break out, risk parity and other volatility-targeting funds will be forced to delever -- igniting a self-reinforcing cycle. But for now, Wall Street strategists are telling clients not to sweat.

“The parallel declines in bond markets and equity markets (representing a rise in cross-asset volatility) do tend to work against risk-parity funds and other such volatility control funds, and we are seeing some cases of funds choosing the ‘sell everything’ option,” Masanari Takada, a quant strategist at Nomura, wrote in a note. “However, we estimate that the leverage ratio at risk-parity funds is still low.”

Similarly, JPMorgan Chase & Co. strategist Nikolaos Panigirtzoglou pointed out in a Tuesday note that risk-parity funds’ leverage has stayed below average in February, lessening the pressure to cut exposures. Still, he did warn that elevated positions at balanced mutual funds could lead to an estimated $90 billion of equity selling at the end of the month.

The S&P risk-parity index’s 10- or 30-day swings also show that while it’s been swerving around more, it’s still roughly near its 10% volatility target. It’s a simplification, but it suggests that followers probably won’t have to downsize their bets sharply.

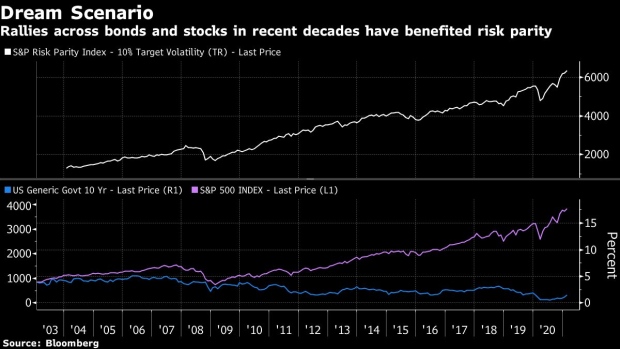

A sustained pick-up in inflation would mark a drastic shift from the post-crisis era, which saw multi-asset funds break one record after another as low rates propelled both bonds and stocks higher. At the same time, the asset classes generally remained diversifying -- a dream scenario for these strategies.

An analysis by quant firm AQR Capital Management last quarter showed the correlation between equities and Treasuries tends to turn positive when inflation surprises to the upside more than economic growth does. But it said the advantage of risk-parity portfolios is that they usually also include commodities, which ordinarily benefit from higher inflation.

Dalio’s Bridgewater Associates, a risk-parity pioneer, famously pared nominal bond exposure last year to shift to inflation-protected notes and gold on fears that government debt would no longer be an effective hedge against equities.

Moves this week offer some support to that argument, but for now it seems there’s no need to fear contagion from the vol-control quants just yet.

“We are still some distance from having to worry about a systematic, unbroken run of selling serious enough deepen and prolong this risk-off phase,” Takada wrote.

©2021 Bloomberg L.P.