Mar 24, 2023

Riskiest Borrowers Left Behind in US Corporate Bond Rebound

, Bloomberg News

(Bloomberg) -- Investors are steering clear of corporate America’s most vulnerable borrowers, even as credit markets rally on bets that the worst of the global banking crisis may be over.

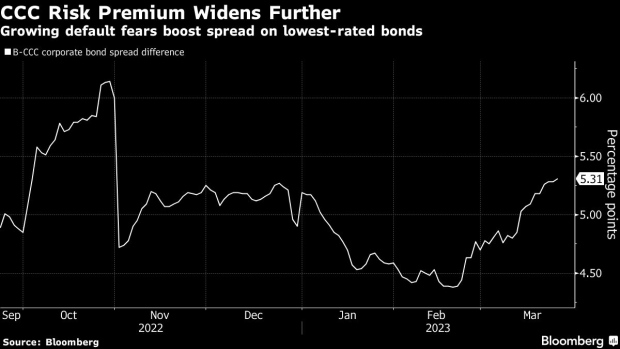

The gap in spreads between the two weakest tiers of corporate debt typically issued — B and CCC — has widened dramatically since the end of February after three US regional banks failed and Credit Suisse Group AG was hastily taken over. It now costs CCC issuers on average 531 basis points more than B rated issuers to sell bonds, according to data compiled by Bloomberg.

The disparity comes as fixed-income traders allocate money into safer credits, such as investment-grade or US government debt, amid concerns that borrowers in the lowest-rated rung of corporate debt are even more at risk of defaulting than usual as tumult in the banking sector, a potential recession and rising interest rates collide.

“A lot of these CCC issuers are zombie companies that were kept alive because of easy money policies and slapdash underwriting,” said Hunter Hayes, portfolio manager of the Intrepid Income Fund at Intrepid Capital Management. “As these companies report earnings, investors are starting to realize just how pernicious the combination of inflation and higher rates can be.”

Rising rates had already made it hard for high-yield companies to court financing. The global banking crisis and the Federal Reserve’s decision to keep hiking — with another 25 basis point raise Wednesday — only exacerbated the situation.

Meanwhile, Hayes suspects there is still a lot of “hidden risk” in the market, and that Silicon Valley Bank and the other lenders that have folded so far won’t be the only casualties.

High-yield companies that are trying to refinance existing debt are also likely to struggle, according to Christina Padgett, associate managing director of North America corporate finance at Moody’s Investors Service.

“So goes the credit conditions broadly, so will go the refinancing market for the weakest credits,” Padgett said.

It’s a bit of deja vu for money managers who weathered debt markets in March 2020 when nearly $1 trillion of bonds traded at distressed, reaching levels not seen since 2008. CCC issuers at the time found themselves locked out of the market as investors pulled back on risk, much like now.

The primary junk market has been frozen, with just $4.15 billion pricing month-to-date — the lowest March volume since 2020. The $38 billion raised so far this year is the weakest tally since 2016.

“You have a lot of moving pieces right now, not a lot of them favorable for the weakest credit,” said Noel Hebert, a US credit strategist at Bloomberg Intelligence. “That all contributes to a backdrop where those that, for all intents were insolvent, can no longer cling to a distressed exchange or some other out of court capital transformation.”

A looming wall of high-yield debt coming due in the next few years is also weighing on these borrowers. US speculative-grade companies have about $1.5 trillion of debt maturing from 2023 to 2027, according to a Moody’s report.

While that figure isn’t much higher compared to a year ago, or the year prior, “what has changed is the market and the appetite for risk,” said Paloma San Valentin, head of North America corporate finance at Moody’s, in an interview. “Investors are becoming more selective and they’re not going to be as accommodating as when debt was quasi-free.”

Back then, however, the Federal Reserve stepped in to backstop bond markets. Now the opposite is occurring, leaving no safe shelter for issuers that find themselves strapped for cash. CCC spreads fell into distress last week and stand at 1,058 basis points over Treasuries, up 16 basis points for the week and hitting a 5-month high. CCC yields soared to 14.11%.

--With assistance from Michael Gambale.

©2023 Bloomberg L.P.