Hong Kong Developer Weighs Stake Sale in London Office Skyscraper Project

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Zhao Xiaowei did what would have been unthinkable just a few years ago: He quit his Beijing barista job and returned to his northeastern rust-belt hometown for a better future.

Feb 19, 2021

, Bloomberg News

(Bloomberg) -- New York’s real estate market started 2021 with a whimper.

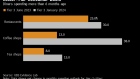

Rents in Manhattan and Brooklyn had the steepest year-over-year drop on record in January, according to a new report from StreetEasy, with Manhattan rents slipping 15.5% and Brooklyn rents down 8.6%. Home prices in January also showed major declines compared to a year prior, according to the report, falling a precipitous 6.2% in Manhattan and 5.4% in Brooklyn.

A recent surge in contract activity suggests at least some improvement on last month’s dismal results. Pending sales, meaning homes that have already gone into contract, are up 30.8% in Manhattan in comparison to January 2020. In Brooklyn, pending sales are up 17.3% for the same time frame.

The contrast between rising sales volume and sinking prices is a simple question of supply and demand, says Nancy Wu, an economist at StreetEasy. Sales might have boomed compared to last January, but a year’s worth of inventory that sat fallow during the pandemic continues to dwarf demand.

“Inventory has been at record highs, and buyers have had more options,” Wu says. “What’s happening now is that sellers seem to be coming to terms with the fact that there’s record inventory on the market, and unless they reduce prices significantly, it won’t sell.”

Luxury Slump

This oversupply, Wu says, is particularly pronounced in the luxury tier, which StreetEasy pegs at over $3.7 million.

“There’s 25% more inventory than last year in the luxury tier,” she says. “This glut of inventory means that prices have even more room to fall, which would then lead to more contracts. So it’s a pretty busy market right now.”

That’s something of an understatement. StreetEasy’s January report found that Manhattan saw a 57% increase in luxury contracts signed year over year, “and even with that surge,” Wu says, “inventory for luxury homes has still been near all-time highs.”

This isn’t good news for New York’s sellers, who will have to get used to even deeper price cuts, Wu says. “There’s no end in sight for how long prices will continue to decline,” she says. “This 6% drop in Manhattan seems to be the first milestone of what’s yet to come.”

©2021 Bloomberg L.P.