Dec 7, 2017

Rogers has 'real intent' to test Blue Jays market value: Former MLSE exec

, BNN Bloomberg

The Toronto Blue Jays will be a coveted asset if – and probably when – the team hits the open market, according to one former Toronto sports executive.

“These type of assets – what I would call trophy assets – are quite limited in North America,” Brian Cooper, former vice-president of business development and operations at Maple Leaf Sports and Entertainment and former Toronto Argonauts president told BNN on Thursday.

“There’s only about 140 major league teams between baseball, football, soccer, basketball in North America. It’s a much sought-after commodity in many cases and they have some great value and they’ve had a great history in appreciating assets.”

Cooper, who is currently president and CEO of MTKG Canada, added that Rogers chief financial officer Tony Staffieri’s Tuesday night comments that the company is looking for ways to "surface value" from the club were more than a hypothetical situation.

“I don’t think you float that idea in the public forum that he was in without having some real intent to test the market at some point,” Cooper said.

Rogers purchased an 80-per-cent stake in the team for $160 million in 2000, later snatching up the remaining 20 per cent.

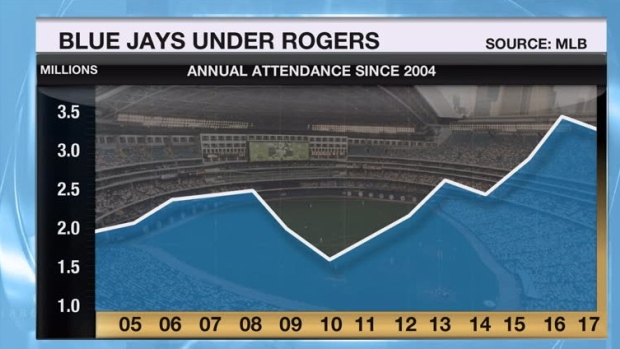

Since then the club has seen remarkable improvement in nearly every facet. Attendance has jumped from 1.7 million over the 2000 season to upwards of 3 million in 2016 and 2017. The club also returned to the post-season – advancing to the American League Championship Series in 2015 and 2016 - for the first time since winning the World Series in 1992 and 1993.

Forbes currently values the club at US$1.3 billion, with revenue of US$278 million.

Cooper believes that a team with the Jays’ market and broadcast reach – being Canada’s only Major League Baseball franchise - would be a hot commodity, but that most pro sports leagues would prefer a company like Rogers sell to an individual.

“I can’t speak for Major League Baseball, but most leagues would prefer to have individual owners than corporations,” Cooper said, drawing comparisons to the 2012 sale of the Los Angeles Dodgers to a group of investors fronted by basketball legend Magic Johnson.

“They would prefer to have individuals that are deep-pocketed, that are experienced in the space.”