Jun 15, 2021

Romania Central Banker Flags Risk of ‘Persistent’ Price Triggers

, Bloomberg News

(Bloomberg) -- The risk of “potentially persistent” inflation drivers should be given heightened scrutiny by Romania’s central bank, according to board member Cristian Popa.

While higher domestic power costs following that market’s liberalization are likely to prove a temporary phenomenon, the economy’s post-lockdown bounce and the ramp-up in global commodity prices could stoke longer-term inflation expectations, Popa said in an emailed response to Bloomberg questions.

“It’s justified to pay increased attention to the more persistent factors rather than those with a transitory character,” Popa said. He declined to comment on the outlook for interest rates.

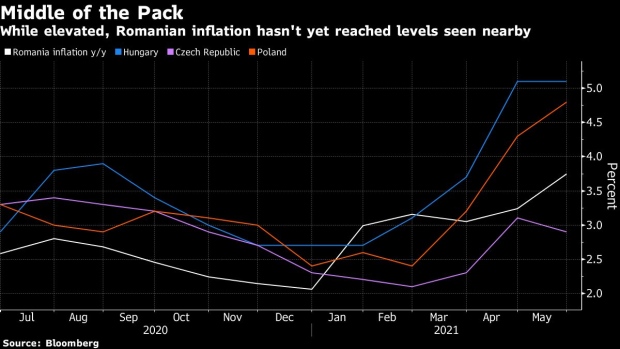

Romania’s in the middle of the monetary-policy pack in the European Union’s east. On one side, Hungary and the Czech Republic are on the verge of lifting interest rates to combat inflation, while on the other Poland has doubled down on near-zero borrowing costs in the face of price growth hitting a decade high.

Most analysts expect Romania to keep rates where they are until the economic recovery is on a firmer footing. At 1.25%, its benchmark is already the EU’s highest. So far, that’s not restraining the rebound, which is projected to be among the EU’s quickest.

The bloc wants Romania to use the period of expansion to help narrow a budget gap that already topped the 3%-of-output limit when the pandemic hit. Prime Minister Florin Citu pledged to trim the shortfall to 3% by 2024 from about 7% this year.

“The fiscal-consolidation process is of utmost importance to our evaluations of broad macroeconomic conditions and thus on the future monetary-policy stance.” Popa said.

©2021 Bloomberg L.P.