Mar 18, 2020

Ruble’s Plunge Has Traders Weighing Bank of Russia’s Options

, Bloomberg News

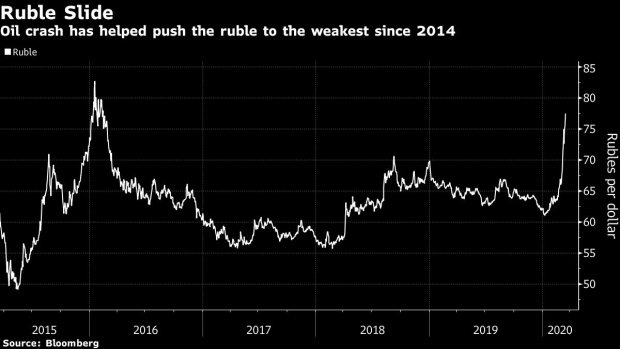

(Bloomberg) -- Russia’s ruble tumbled the most in emerging markets on Wednesday, erasing a fifth of its value in the year so far as crude sank to $28 per barrel.

Fears of a worldwide recession and a flight to the dollar are squeezing all risky assets, but the markets of the world’s biggest energy exporter are being hit particularly hard after President Vladimir Putin plunged into an oil-price war with Saudi Arabia. Russian local currency bonds and the ruble were one of the biggest overweight calls in the asset class last year. Now the ruble’s more than 20% plunge year-to-date is the worst performance globally.

While central banks from developed nations to emerging markets have come forward with emergency rate cuts to keep cash cheap for their battered economies, Russia is seen bucking the trend. Thirty-four out of 35 economists in a Bloomberg survey expect Governor Elvira Nabiullina to end a run of six cuts and put rates on hold on Friday in a bid to avoid weakening the currency.

Market snapshot:

- Ruble sinks 3.3% to 77.9900, weakest since February 2016

- Nordea analysts Grigory Zhirnov and Tatiana Evdokimova see the currency trading at 75-82 against the dollar if brent stays between $20-30. If it nears the higher end of that range, Bank of Russia could intervene in the market “to limit financial stability risks,” they write

- Ruble’s one-week implied vol is highest globally at 42.98%

- 10-year generic ruble-bond yields jump 21bps to 8.27%, the highest in almost a year

- Forward-rate agreements currently predict 122bps of hikes over coming three months; they predicted cuts at the start of the month

Piotr Matys is the sole economist not predicting a cut on Friday. Nabiullina will be weighing the ruble against potential recession, making the direction of the rate decision a “very close call.” The impact of the ruble’s drop on inflation will be more muted than in 2014, said Matys, who predicts a 50 basis-point reduction.

“When central banks in both developed and emerging economies are slashing interest rates at emergency meetings perhaps we should seriously consider the possibility of a cut in Russia.”

©2020 Bloomberg L.P.