Oct 6, 2020

Ruble’s Slump Has Killed Hopes of Further Rate Cuts in Russia

, Bloomberg News

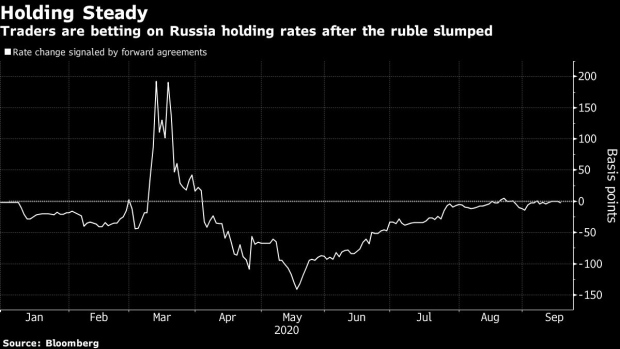

(Bloomberg) -- Traders are betting that the Bank of Russia will put interest rate cuts on hold after the ruble’s 9% slump against the dollar in the past three months.

Forward-rate agreements, which have been predicting more monetary easing for most of this year, are now indicating that rates will stay at 4.25% for the rest of the quarter. Economists say monthly inflation data for September due Tuesday is unlikely to change the outlook, even though it’s expected to show price growth below target for a 12th consecutive month.

“The weakness in the ruble is a reflection of a more challenging external environment,” said Jens Nysted, who invests in Russian government bonds as a senior portfolio manager at Emso Asset Management in New York. “We would expect the Bank of Russia to keep rates on hold until after the U.S. election.”

Analysts at Macro Advisory, a Moscow-based research house, described the ruble as the “currency of fear” last week because the exchange rate reflects so many different possibilities of fresh sanctions against Russia. The biggest concern comes from the prospect that Joe Biden will chose to crack down harder on Russia than President Donald Trump if he wins the U.S. presidential election in November.

Officially the central bank doesn’t interfere in the exchange rate, but bond market flows are a major driver of the currency so cutting interest rates now could increase volatility. Governor Elvira Nabiullina warned at the last meeting that the ruble’s slump was feeding into faster price rises.

The central bank paused its easing cycle last month after 200 basis points of cuts this year and said that it will weigh the need for another reduction. Since then the ruble has lost 3.8% of its value against the dollar as the European Union weighed sanctions over the poisoning of opposition activist Alexey Navalny and fighting broke out between Armenia and Azerbaijan.

Sanctions Risk Is Back in Russia. Here’s What’s at Stake

The next rates meeting will be held on Oct. 23., just 11 days before the U.S. election. Deputy Bank of Russia Governor Alexey Zabotkin gave no hints about the direction of rates when he spoke in the upper houses of Russian parliament on Monday.

“If the ruble stays near the current level, which we see as our base-case scenario for the next two months, there will be no more rate cuts this year,” Renaissance Capital Chief Economist Sofya Donets said in Moscow. “Inflation is not the main factor for the Bank of Russia, the main deciding point is the ruble rate.”

©2020 Bloomberg L.P.