Jan 14, 2022

Runaway Inflation a Wake Up Call in Asia Too as Bond Yields Rise

, Bloomberg News

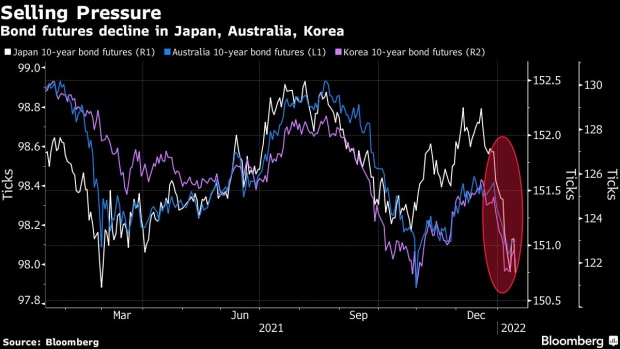

(Bloomberg) -- Bonds dropped across most of Asia Friday amid concern the region won’t be spared the impact of rising global inflation pressures.

Shorter-maturity yields in Japan, Australia and South Korea all climbed, along with those on U.S. Treasuries, bringing an end to the global rally in debt markets earlier this week. Amid bond negative news was a hawkish interest-rate hike from the Bank of Korea and better-than-expected economic data in Australia.

Japan’s five-year yields rose to the highest level since early 2016 after Reuters reported the central bank may raise rates even before annual inflation reaches its target of 2%, citing a source similar with the BOJ’s thinking.

“Japan’s five-year yields have backed up to the highest level since 2016, dragging two- and five-year Australia and U.S. front-end sovereign yields higher in Asia,” said Prashant Newnaha, an Asia-Pacific rates strategist at TD Securities in Singapore. The increase is being driven by “speculation that the Bank of Japan may revise up its growth and inflation forecasts next week and dollar-yen stops have played their part in driving front-end yields higher,” he said.

Japan’s five-year yield climbed 2.5 basis points to minus 0.015%, the highest since January 2016. Australia’s three-year yield increased as much as six basis points to 1.23%, the highest since October. Korea’s three-year yields jumped eight basis points to 2.04%.

Korea’s central bank raised its benchmark rate to 1.25% as economists forecast, underscoring its determination to curb inflation and limit financial risks to the economy. Policy makers said they expected inflation to stay above mid-2% range “for a considerable time.”

Australia reported a faster-than-anticipated growth in home loans, with the value of new loan commitments for owner-occupied housing jumping by the most since January 2021.

Markets are clearly testing the notion that the Reserve Bank of Australia’s dovish stance on monetary policy can run independent of global monetary policy developments, TD Securities’ Newnaha said.

©2022 Bloomberg L.P.