Apr 9, 2020

Rush Into U.S. Government Money Funds Slows From Breakneck Pace

, Bloomberg News

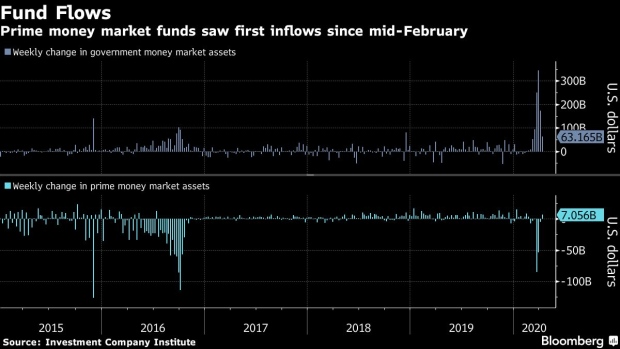

(Bloomberg) -- The pace of cash pouring into U.S. government money-market funds slowed from the records set in recent weeks, while prime funds saw their first inflow in two months, adding to signs that investors may be growing more confident about a recovery in short-term credit markets.

The net inflow to government funds was $63 billion in the week ended April 8, the Investment Company Institute said Thursday. That’s down from $174 billion the prior week and the record $345 billion set the period before that. Total assets rose to a record high of $3.68 trillion.

The $7.1 billion added to prime money-market funds broke a six-week streak of investor redemptions that amounted $155 billion. Total assets of these funds -- which tend to invest in higher-risk assets such as commercial paper -- are now $661.4 billion.

©2020 Bloomberg L.P.