Sep 13, 2022

Russia Energy Revenue Drops to 14-Month Low on Sanctions Fallout

, Bloomberg News

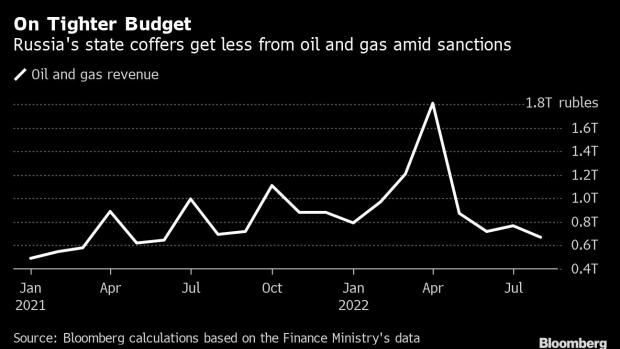

(Bloomberg) -- Russia’s energy revenues shrank in August to the lowest in more than a year as Western sanctions over Ukraine prompted the Kremlin to sell discounted oil and squeeze gas flows to Europe.

The refusal to buy Russian oil by some traditional customers in Europe means Moscow has been forced to sell oil at a steep discount in Asian markets, depriving it of the full benefit of higher prices. While August saw record-high spot gas prices in Europe, gas levies, which take up a smaller share in the budget, couldn’t fully offset lower oil revenues. State-run Gazprom PJSC has significantly cut gas exports to Europe this summer, blaming sanctions for capped flows.

Russia’s oil and gas revenues, which account for more than a third of nation’s budget, fell to 671.9 billion rubles ($11.1 billion) last month, the lowest since June 2021, according to Finance Ministry’s data published Monday. That’s a drop of almost 13% from July. It’s also a 3.4% decline from a year ago, even though Urals crude prices rose almost 10%.

Another blow to the Kremlin’s coffers could come from the price cap that Group of Seven nations plan to set for Russian crude and oil products. While President Vladimir Putin pledged to halt exports to countries that introduce such a measure, the price cap could further increase the discount for remaining buyers of Russian fuel.

The monthly drop in Russia’s August oil and gas revenues is a result of tax payment rules, according to the Finance Ministry. Russian oil producers normally pay a profit-based tax, or NDD, for the preceding quarter in April, July, October and January. As a result, the NDD gave an additional boost of 306.3 billion rubles to the July oil and gas revenues, according to RBC news outlet.

©2022 Bloomberg L.P.