Feb 23, 2022

Russia ETF Sees Biggest Inflow Since June 2018 Amid Sanctions

, Bloomberg News

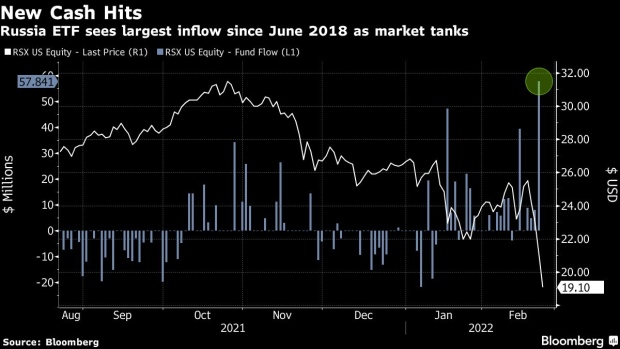

(Bloomberg) -- The most popular exchange-traded fund holding Russian equities saw its largest inflow of cash in more than three years, just as the nation’s local markets are reeling from geopolitical tensions.

The $1.4 billion VanEck Russia ETF (RSX) lured almost $58 million on Tuesday, the most since June 2018, as Russia faces sanctions from the U.S. and Europe, according to data compiled by Bloomberg. Russian stock markets were closed for a holiday, but the U.S.-listed fund was still trading. RSX is on track to post its best month of inflows since December 2020, even as the country’s currency hit its weakest level on Wednesday since the onset of the pandemic.

The inflow may indicate so-called create-to-lend activity, in which new shares are created for traders to borrow and sell short. RSX’s short interest is about 26% of the float, up from about 10% just four months ago, according to data from S3 Partners. It’s difficult to know the motivation of the buyer or buyers, according to Carlos Asilis, chief investment officer and founder of advisory firm Glovista Investments.

“It could be part of a long-short trade -- long equities and short in FX or credit,” he said.

Shares of RSX are down more than 9% on Wednesday, as U.S. President Joe Biden expanded sanctions against Russia.

©2022 Bloomberg L.P.