Jun 1, 2022

Russia Fails to Meet Bond Obligations, Triggering Swaps Payout

, Bloomberg News

(Bloomberg) -- Russia was judged to have breached the terms on a bond payment by a derivatives panel, triggering an insurance payout potentially worth billions of dollars.

The Credit Derivatives Determinations Committee said a “failure-to-pay” event occurred on credit-default swaps because Russia didn’t include $1.9 million of additional interest in a late bond payment made at the start of last month.

While a comparatively small amount, the missed interest will trigger all of Russia’s outstanding credit default swaps, entailing a payout on as much as $3.2 billion of debt, with the final amount likely to be set at auction. At the same time, the size of the accrued interest and the fact that the principal payment has already been paid means the ruling won’t spark a broader default on Russia’s bonds.

Pimco Fund Added to Russia Swap Exposure in Weeks Before War

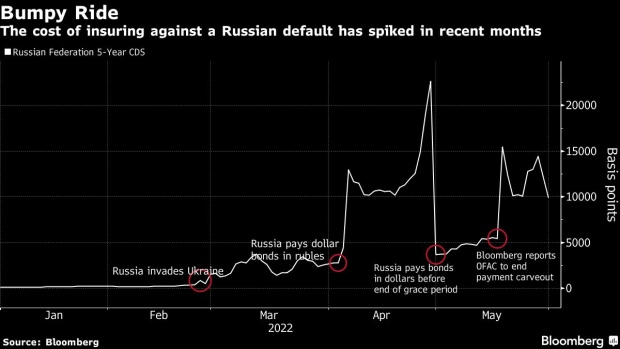

The ruling comes as Russia struggles to stay current on its foreign debt payments amid sweeping sanctions over its invasion of Ukraine.

The trigger is a boon for those that entered into a popular trade pitched by banks in the weeks following Russia’s Feb. 24 invasion of Ukraine -- the so-called basis trade where investors buy both the bonds and credit default swaps. The bonds in question have already matured, so holders stand to be paid twice -- first on the bonds themselves and again on the insurance.

Russian Bond Arbitrage Is Minting Near-Guaranteed Profits

Investors piled into Russia’s credit default swaps, while also buying the beaten-down government or corporate debt the swaps are tied to. In normal times, the economics of such a transaction don’t make much sense. The cost of the debt and the hedges move inversely, typically offsetting each other.

But for much of March, as institutional investors were rushing to offload their stakes in Russian assets amid mounting public outrage, bond prices were falling faster than the cost to hedge was rising.

The committee’s latest review stemmed from a delay on the repayment of a bond at maturity, in early April.

Russia’s initial attempt to transfer rubles on the note was ruled a “potential failure-to-pay” event by the CDDC. But that eventually came to nothing as Russia sent dollars through to investors with days remaining before the end of a 30-day grace period on May 4.

It was during that grace period that the $1.9 million the committee was considering on Wednesday accrued.

(Updates with chart, background)

©2022 Bloomberg L.P.