May 3, 2023

Russia Halts Some Oil Wells But Keeps Production Data Secret

, Bloomberg News

(Bloomberg) -- Russian oil data show a jump in the number of idled wells in March, adding another contradictory element to the murky picture of whether the country really is cutting crude production as promised.

Moscow pledged to curb output by 500,000 barrels a day in retaliation for western energy sanctions and to support the price of its oil. Deputy Prime Minister Alexander Novak has said the cuts were implemented by the end of March and maintained in April, but official production data is being withheld and tanker tracking shows no corresponding drop in seaborne exports.

With oil futures dropping below $70 a barrel in New York on Wednesday due to concerns about the risk of recession and weakening demand, the question of whether Moscow is flouting the OPEC+ cuts agreement has gained urgency.

Russia’s official oil-output data was classified after the invasion of Ukraine due to its “sensitive” nature. That means market-watchers have to rely on other figures, such as seaborne exports and domestic flows to assess whether the cuts have materialized.

The proportion of idled and shut-in wells could be an indication that Russia’s producers have taken steps to reduce output. They jumped to 18.1% in March, compared with 15.6% in February, according to industry data seen by Bloomberg. That’s the largest proportion of inactive wells for the nation since May 2022, when the country was making short-term output cuts amid the first waves of international energy sanctions following its invasion of Ukraine.

But the figures have are some key limitations. They provide no information on the productivity of the wells affected, making it impossible to gauge the actual impact on output.

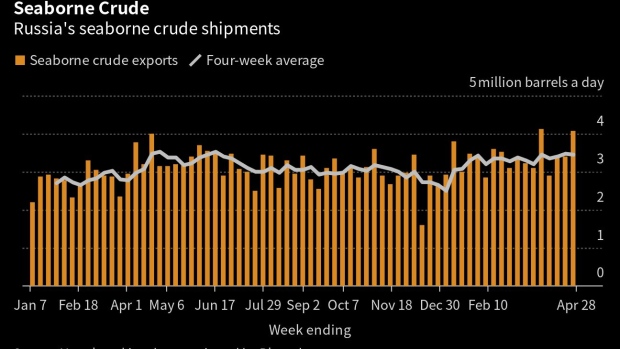

Another key indicator shows no evidence of significant reductions in Russian output. The country’s seaborne crude exports jumped back above 4 million barrels a day in the week to April 28, a level it has surpassed only once since its troops invaded Ukraine in February 2022, according to tanker-tracking data compiled by Bloomberg.

Yet overseas crude shipments don’t tell the full story. Russia has a large domestic refining industry where crude intake is currently in flux due to seasonal maintenance. It also exports oil via pipelines, with little visibility over the level of flows.

Two oil producers - Bashneft PJSC and Slavneft PJSC, a joint venture between Rosneft PJSC and Gazprom Neft PJSC - reported the biggest increase in the share of inactive oil wells, the data show. In the case of Bashneft, a unit of Rosneft that operates mostly mature oil fields in the Volga-Urals region, the proportion of such wells jumped to nearly 44% from 29.2% in February.

Major oil producers, like Rosneft, Lukoil PJSC and Tatneft PJSC also raised the number of inactive wells but to a lesser extent.

©2023 Bloomberg L.P.