Jun 11, 2021

Russia Hikes Rates 50 Basis Points After Surprise Inflation Jump

, Bloomberg News

(Bloomberg) -- Bank of Russia delivered its third straight increase in interest rates as a recovery from the pandemic combined with a surge in global food prices to accelerate inflation faster than expected.

The benchmark rate was raised to 5.5% on Friday, the highest level in more than a year, the Bank of Russia said in a statement. The move was forecast by 30 of the 36 economists polled in a Bloomberg survey. The rest expected a smaller hike.

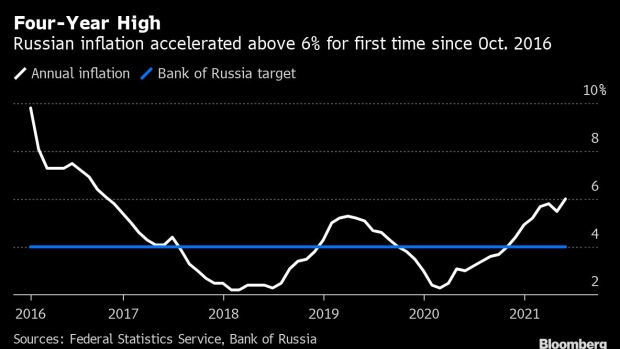

Governor Elvira Nabiullina is battling a surge in consumer prices that has pushed annual inflation above 6% for the first time in more than four years. The central bank has increased interest rates by 125 basis points since March but consumer price growth is still well above a 4% target.

Nabiullina will hold an online news briefing at 3 p.m. Moscow time. Follow the event on our live blog here.

Key Insights:

- Nabiullina warned last week that recent jumps in inflation are driven by lasting factors and said the central bank is determined to prevent an inflationary spiral from taking hold. She said rising inflation expectations create added risks.

- Finance Minister Anton Siluanov said last week that the economy is “overheating.” Economists forecast inflation to start easing in the fall.

- Global food prices extended a rally to the highest in almost a decade this month, pushing up concerns about rising grocery bills in many developing nations. In Russia, rising prices for staples like sugar and sunflower oil have become a political issue, with the government introducing curbs on some exports.

- A rally in the ruble since April should help tame inflation when it follows through into consumer prices in a few months. The currency climbed to a nine-month high against the dollar earlier this week, buoyed by a jump in global crude prices and expectations of today’s rate rise.

©2021 Bloomberg L.P.