Sep 5, 2019

Russia LNG Ambitions Advance With Plans for Remotest Regions

, Bloomberg News

(Bloomberg) -- Russia took a step closer to becoming a dominant player in the global liquefied natural gas market as two of its biggest energy companies advanced plans to export the fuel from its remotest corners.

Rosneft PJSC, Russia’s top oil company, said Thursday it plans together with its partners in the Sakhalin 1 project to build an LNG export plant in the far eastern port city of De-Kastri. Meanwhile Novatek PJSC, the country’s largest LNG producer, made a final investment decision on its $21 billion Arctic LNG 2 plant on the Gulf of Ob.

Natural gas is expected to be the fastest growing fossil fuel through 2040, and it will increasingly be transported in liquid form, according to the International Energy Agency. China, India and other developing countries plan higher imports to bring energy and electricity to their people at a fraction of the pollution of coal or oil.

The two projects combined could export about 26 million tons of LNG a year, which would double Russia’s existing capacity. Already the world’s top exporter of pipeline gas and second-biggest shipper of crude oil, LNG will give President Vladimir Putin a bigger role in driving the world economy via his country’s massive energy resources.

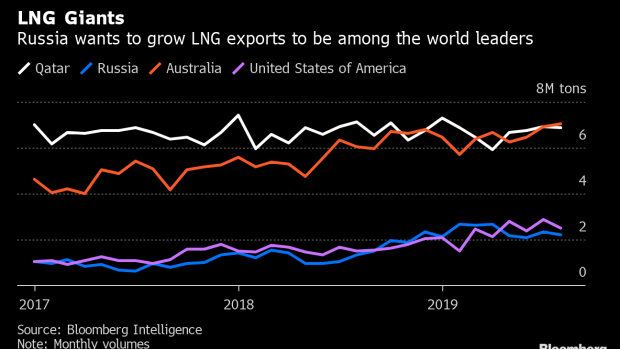

Russia, which had 8% of the global LNG market last year, wants to boost that to 20% by 2035 to put it in league with the world’s biggest exporters, such as Qatar, the U.S. and Australia. Thursday’s announcements, made at the Eastern Economic Forum in Vladivostok, underscore how quickly the country is progressing toward that goal. Its first plant, at Gazprom PJSC’s Sakhalin 2, opened in 2009 and its second, Novatek’s Yamal LNG, only started in 2017.

The first production unit at Arctic 2 LNG will come online by the end of the third quarter of 2023, Novatek Chief Executive Officer Leonid Mikhelson said. Once fully complete, the plant will be able to produce 19.8 million tons of LNG annually. Rosneft CEO Igor Sechin didn’t give a timeline for the far east LNG plant, which he said would be able to produce about 6.2 million tons a year.

Russian projects are competing with those in Mozambique, the U.S. and Qatar for customers early next decade, when demand growth is expected to surpass available supply. For now, several export projects, including Yamal, have come online recently and saturated the market, depressing spot LNG prices in Asia to about 60% below where they were a year ago.

To contact the reporters on this story: Olga Tanas in Vladivostok at otanas@bloomberg.net;Dina Khrennikova in Vladivostok at dkhrennikova@bloomberg.net;Dan Murtaugh in Singapore at dmurtaugh@bloomberg.net

To contact the editors responsible for this story: Ramsey Al-Rikabi at ralrikabi@bloomberg.net, Jasmine Ng

©2019 Bloomberg L.P.