May 23, 2022

Russia May Ease Key FX Limit as Ruble Surge Hits Budget, Economy

, Bloomberg News

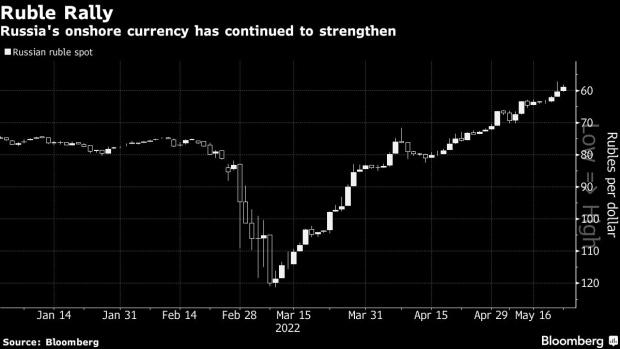

(Bloomberg) -- Russia is considering a plan to ease a key control on capital flows which has helped drive the ruble to the highest levels in four years.

With the rally now threatening to hurt budget revenues and exporters, a decision to cut the share of hard-currency revenue exporters must convert into rubles to 50% from 80% could come as early as this week, according to two people familiar with the matter, who requested anonymity because the details of the plan aren’t public.

The ruble’s rebound has left it 30% stronger against the dollar than it was before Russia invaded Ukraine on Feb. 24. Authorities have been gradually easing the strict limits on foreign-exchange operations imposed in the days after the invasion to stem a sharp drop in the currency.

The restrictions, combined with a collapse in imports amid the sweeping sanctions the US and its allies imposed on Russia, all but eradicated demand for foreign currency just as supply surged thanks to high prices for largely unsanctioned energy exports.

On Friday, the ruble closed at the highest level in five years against the euro as more European companies appeared to be complying with President Vladimir Putin’s demand that they switch to paying in Russia’s currency for natural gas.

The currency resumed its surge on Monday morning, climbing 2.3% against the dollar to 58.88. Tass first reported the plans to reduce the requirement for mandatory sales by exporters.

Putin Sets Russians on Wild Hunt for Dollars in Black Market

Sanctions on the central bank’s reserves mean it can’t conduct the foreign-exchange purchases it did regularly before the invasion.

‘Regulatory Burdens’

Russia’s big-business lobby has meanwhile raised the alarm about the ruble’s rally, announcing the creation over the weekend of a special working group to monitor the currency situation.

“Excessive regulatory burdens on businesses in the area of currency regulation and control must be avoided,” the Russian Union of Industrialists and Entrepreneurs said in a website statement.

Ruble strength is also potentially bad news for the budget, which gets a substantial chunk of revenues from energy taxes denominated in foreign currency but spends in rubles.

“The stronger the rate, the bigger the deficit will be,” said Evgeny Kogan, a professor at Moscow’s Higher School of Economics. “And it makes things harder for exporters, raising costs and reducing revenue” in ruble terms.

“If this lasts for for, say, half a year, it will be extremely unpleasant,” he said, noting that a more “comfortable” rate for the economy would be around 75-80 per dollar.

The press offices of the Bank of Russia and the Finance Ministry didn’t immediately respond to a request for comment.

©2022 Bloomberg L.P.