Nov 18, 2020

Russia’s Fix Price Draws Goldman Investment as Wages Stagnate

, Bloomberg News

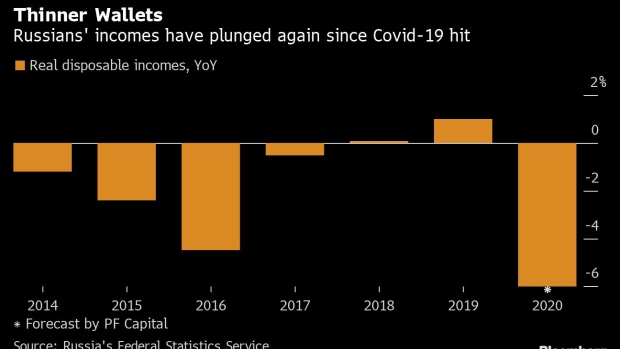

(Bloomberg) -- Fix Price has expanded its sales of household goods at knockdown prices quarter after quarter as Russia’s real wages stagnate, winning the backing of Goldman Sachs Group Inc. early this year.

Russia’s biggest dollar-store retailer plans to build on the previously unreported sale of a minority stake to the Goldman Sachs fund, according to Fix Price founder Sergei Lomakin. Asked about an initial public offering, he said it’s among the company’s strategic options. A spokesman for Goldman Sachs in Russia declined to comment.

Fix Price, operating on a model similar to Dollar Tree Inc. in the U.S., is prospering as wages fail to recover from the 2014 collapse of the ruble, and real incomes have fallen the most in more than a decade this year. But the increased frugality and the government’s reluctance to impose a lockdown against the coronavirus pandemic may benefit discounters.

“With shrinking incomes, consumers try to avoid shopping in large supermarkets, where you never know how much money you’ll end up spending,” Lomakin said an interview.

Fix Price reported 16% growth in same-store sales for the first nine months of 2020 and has posted double-digit growth for 15 consecutive quarters. The company may be valued at $2 billion with Lomakin’s stake worth at least $800 million, according to the Bloomberg Billionaires Index.

Discounters of all stripes have been expanding in Russia amid the fall in living standards. No-frills food retailers like Svetofor have been so successful that the country’s biggest grocery chains X5 Retail Group NV and Magnit PJSC have copied the format, opening stores this year with limited assortment and a focus on private-label products.

When Lomakin and his business partner opened their first dollar stores in 2007, it was an anomaly in Russia. Bound by a non-compete agreement after selling stakes in Russian discount grocer Kopeyka, they studied the format -- which focuses on non-food goods -- in the U.S. and Japan.

“Our eyes and hands were on fire,” Lomakin said. “It was a new format not yet present in Russia.”

After the ruble’s collapse in 2014, Fix Price slashed imports and introduced a range of price points to protect against currency volatility, taking a cue from Canada’s Dollarama Inc., according to Lomakin. It now prices goods from 50 rubles to 199 rubles ($0.65 to $2.60).

Last year, earnings before interest, taxes, depreciation and amortization reached 19% of revenue. That beats any publicly traded retailer in Russia, according to Gazprombank analyst Marat Ibragimov.

Catering to people’s desire for something novel, Fix Price rotates in about 50 new products a week to draw “treasure hunters,” according to Chief Financial Officer Anton Makhnev.

“With less money for travel and restaurants, people still want to delight themselves,” Makhnev said. “So consumers are turning to us.”

©2020 Bloomberg L.P.