May 22, 2019

Russia's Newest Ambition in China Is Selling More Chicken Wings

, Bloomberg News

(Bloomberg) -- Russia’s ambition to become a global player in the chicken market is getting a helping hand from the virus decimating China’s hog herd.

For the first time since the Soviet era, Russia is sending poultry to China. The market for cheaper alternatives to pork is opening up as analysts say China could lose 30% of its pigs to African swine fever. The move could be a big step forward for Russia’s poultry industry, which wants to become a major supplier to more countries.

It’ll likely take time to seriously challenge major shippers like the U.S., Brazil and European Union, but last month’s sale of chicken wings could be a warning of more competition for exporters hoping to send more to China. After doubling poultry output in the past decade to rank as the No. 6 producer, Russia may already be able meet some of China’s needs. For example, its chicken exports last year were equal to a third of Chinese imports.

“We expect China to be among our main customers,” said Andrei Terekhin, head of the export department at Russia’s Cherkizovo Group, which plans to ship poultry to China soon. “The situation is favorable for entry to the market.”

Russia still imports a bit more chicken than it exports, and until earlier this decade didn’t produce enough chicken to warrant sales to China. But after six years of talks -- clouded by Russian outbreaks of bird flu -- China last year agreed to allow imports.

Miratorg Agribusiness Holding sent 54 tons of wings to China in April, and the Russian National Meat Association said the country could send tens of thousands of tons there within a couple of years.

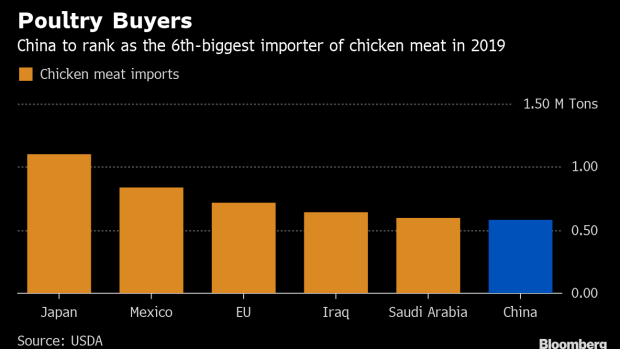

China will need to import more pork and substitute meats following outbreaks of African swine fever, which has spread to neighboring countries and led to more than 1 million pigs being culled. The country’s poultry imports will jump 68% to 575,000 tons this year, the U.S. Department of Agriculture forecasts.

Compared with chicken, Russia is an even smaller exporter of pork, but aims to also eventually start exports of that meat to China, Japan and South Korea. Sino-Russian talks remain ongoing as Russia deals with its own outbreaks of African swine fever.

Russian poultry sales to China could be a potential setback for chicken companies in other countries who stand to benefit from the virus fallout. Shares of America’s Pilgrim’s Pride Corp. and Brazil’s JBS SA surged at least 84% this year amid expectations of more business, and U.S. chicken thigh prices are near the highest since 2017.

Russia, which two decades ago was the top poultry importer, mainly exports to other Asian countries and Africa. Domestic output has the potential to rise by several hundred thousand tons if all existing capacity is used, the Russian National Meat Association said. That could cover the needs of a major importer.

“Russia is close to becoming a net exporter of chicken meat,” said Sergei Yushin, head of the association’s executive committee. “Russia should become one of the largest suppliers on the world market. We have the grain to feed the birds and we have built up expertise.”

For now, Russian chicken feet and wings will be among the easiest products to sell to China amid more demand, Cherkizovo’s Terekhin said.

“With the other parts -- legs, dark meat -- we face certain competition from Brazil, the EU and other suppliers,” he said.

To contact the reporter on this story: Anatoly Medetsky in Moscow at amedetsky@bloomberg.net

To contact the editors responsible for this story: Lynn Thomasson at lthomasson@bloomberg.net, Nicholas Larkin, Dylan Griffiths

©2019 Bloomberg L.P.