Oct 21, 2021

Russia’s Renaissance Insurance Raises $250 Million in Moscow IPO

, Bloomberg News

(Bloomberg) --

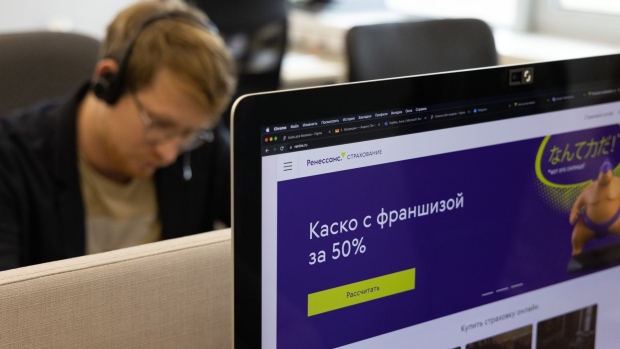

Renaissance Insurance Group JSC, Russia’s largest online policy provider, sold 17.7 billion rubles ($250 million) of new shares in an initial public offering at the low end of its price range.

The company sold as much as 162 million new shares, at 120 rubles each in Moscow, it said in a statement. The sale values the insurance group, controlled by investors led by Boris Jordan, at 66.8 billion rubles. The stake was smaller than initially planned, when the company said it could raise up to 25.2 billion rubles.

Renaissance Insurance is the first to sell shares among several Russian companies seeking to go public this autumn, following Russia’s busiest first half for stock offerings this year since before the annexation of Crimea. IT firm Softline this week set a price range for its IPO, while carsharing service Delimobil and real-estate platform Cian have also filed to sell shares.

Credit Suisse Group AG, JPMorgan Chase & Co. and VTB Capital were joint global coordinators and joint bookrunners, with BCS Global Markets as senior bookrunner. Renaissance Capital, Sberbank PJSC, Tinkoff Bank JS, Sova Capital and Aton also helped organize the sale.

As part of an over-allotment option, selling shareholders include a group of investors led by Jordan, Baring Vostok, Evraz Plc billionaires Alexander Abramov and Alexander Frolov, and Andrey Gorodilov, who worked at Roman Abramovich’s oil producer Sibneft and was later deputy governor of Chukotka.

©2021 Bloomberg L.P.