Mar 3, 2023

Russia’s Revenue From Oil and Gas Almost Halved in February

, Bloomberg News

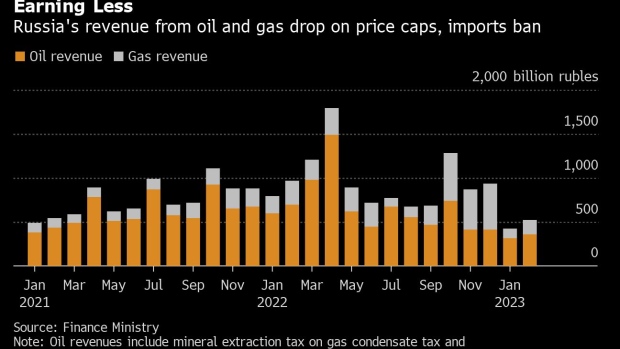

(Bloomberg) -- Russia’s oil and gas revenue almost halved in February after Western restrictions on crude and petroleum products took effect and gas exports to Europe fell.

Tax revenue from oil and gas plunged 46% in February from a year ago to 521 billion rubles ($6.91 billion), the Finance Ministry said on Friday. Proceeds from crude oil and petroleum products — which accounted for over two thirds of energy tax revenue last month — fell by 48% to 361 billion rubles, according to Bloomberg calculations.

The drop in contributions to the nation’s budget comes after the price of Urals crude — Russia’s key export blend — has fallen to a significant discount compared to the Brent benchmark. The European Union banned most seaborne imports of crude and petroleum products from Russia, and the Group of Seven industrialized nations imposed a price cap.

With the price of Urals oil averaging just over half of its value a year ago, Russia is seeking to gradually narrow the discount to Brent it uses to calculate taxes in an effort to boost revenue amid sanctions. Energy proceeds account for around at third of nation’s coffers, which are under pressure amid the rising cost of financing the war in Ukraine.

Read more: Russia Seeks Gradual Cut of Oil Discount to Brent for Taxes

Gas revenue fell almost 42% in February from a year ago to 161 billion rubles, as even higher proceeds from the mineral extraction tax failed to make up for losses from export duties. Budget revenue from gas export duties fell 81% to 40 billion rubles after nation’s gas giant Gazprom PJSC reduced pipeline flows to Europe, historically its largest market, and the fuel price has significantly declined amid warmer-than-usual weather.

Proceeds from the mineral extraction tax on gas rose 86% to 121 billion rubles, gaining from a temporary increase of the tax for Gazprom by 50 billion rubles per month in 2023-2025.

©2023 Bloomberg L.P.