Aug 1, 2022

Russia’s Slump in Oil Exports Abates, Moscow’s Revenues Go Up

, Bloomberg News

(Bloomberg) -- Russia’s seaborne crude shipments have stabilized at a level about 500,000 barrels a day below the peak they reached after Moscow’s troops invaded Ukraine in February and remain little changed from where they were before before the attack.

Outflows rebounded in the week to July 29, hitting a four-week high of 3.5 million barrels a day, according to vessel tracking data monitored by Bloomberg. But four-week average shipments, which smooth out some of the volatility in weekly figures, were little changed at about 3.2 million barrels a day.

Based on current destinations, the average flow of Russian crude to Asia has stabilized at about 1.75 million barrels a day, down from a plateau of more than 2.1 million barrels a day in April and May. Shipments to European buyers, are averaging about 1.3 million barrels a day, down from more than 1.85 million barrels a day before the invasion.

There’s still a long way to go before a drop in shipments hits the Kremlin's war chest hard enough to give President Vladimir Putin second thoughts about his invasion of Ukraine. Rising crude prices have boosted Russia’s export duty rates this month, with four-week average export duty receipts edging higher.

Crude Flows by Destination:

-

Asia

Shipments to China averaged 745,000 barrels a day in the most recent four-week period, down from 810,000 barrels a day in the four weeks ended July 22. Flows to India were 740,000 barrels a day, compared with a revised 828,000 barrels a day.

-

Europe

The volume shipped from Russia to northern Europe fell to a two-month low in the four weeks to July 29, averaging 364,000 barrels a day.

Shipments to Mediterranean buyers rebounded to a four-week high of 758,000 barrels a day, just 66,000 barrels a day below their post-Ukraine-invasion peak. A tanker anchored off Bilbao would mark the first delivery to Spain since April, if it discharges.

Combined shipments to Bulgaria and Romania remained unchanged at 208,000 barrels a day in the four weeks to July 29, at a little more than half their recent peak.

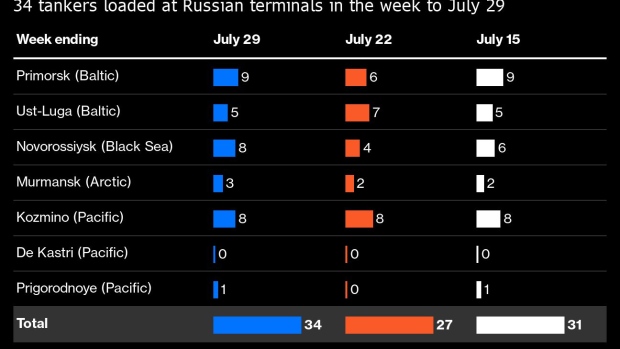

Flows by Export Location

Aggregate crude flows from Russian ports jumped by 567,000 barrels a day, or 19%, to a four-week high of 3.51 million barrels a day in the seven days to July 29. Flows were higher from all regions.

Export Revenue

Moscow’s revenue from export duty jumped to an eight-week high in the week to July 29, up by $25 million, or 16%, to $180, according to calculations by Bloomberg.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from each of the four export regions.

A total of 34 tankers loaded 24.5 million barrels from the country’s export terminals in the week to July 29, vessel-tracking data and port agent reports show. That’s the most in four weeks. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress.

The total volume of crude on ships loading from Russia’s Baltic terminals edged lower in the week to July 29, with a rebound in flows to Asia. A ship heading across the Atlantic is showing its destination as Cuba.

Flows from Novorossiysk in the Black Sea jumped to an eight-week high in the week to July 29, driven by high flows into the Mediterranean.

Arctic shipments rose for a third week.

Crude flows from Russia’s three eastern oil terminals regained the previous week’s losses.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }

©2022 Bloomberg L.P.