Mar 2, 2022

Russia Sanctions Put $41 Billion of Default Insurance at Risk

, Bloomberg News

(Bloomberg) -- Contracts insuring $41 billion of Russian sovereign debt may be rendered worthless, even as they signal a record likelihood of default.

That’s because international sanctions placed on the country in response to President Vladimir Putin’s invasion of Ukraine may both trigger credit-default swaps and also prevent the underlying bonds from being used for settlement, according to strategists and investors at Citigroup Inc., CreditSights Inc. and Vanguard Asset Management.

“As it stands the sovereign debt can be deliverable into CDS,” said Nick Eisinger, co-head of emerging-markets active fixed income at Vanguard in London. “The challenge will be how to do the auction if indeed this is fully sanctioned.”

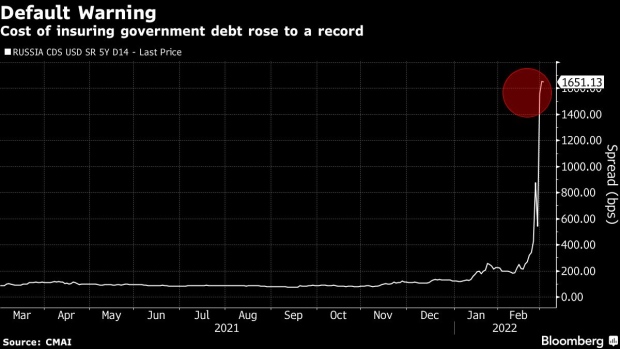

Traders have been rushing to buy protection on Russia’s sovereign debt as the country becomes an almost uninvestable market for global investors. Swaps now signal a 65% chance of default within five years and 40% within one year, according to ICE Data Services.

Investors are clamoring for clarity as the war enters a more brutal phase ahead of looming debt payments. Russia has $117 million worth of coupons on dollar bonds coming due on March 16 and about $5 billion worth of international debt set to mature in the next two years.

“If harsher sanctions are implemented that prohibit holding all existing Russian sovereign debt, this could have a material impact on the ability of the CDS market to hold an auction, or settlement in the event of any credit event trigger,” CreditSights analysts wrote in a note on Tuesday.

Credit-default swaps only protect against losses on Russia’s foreign-currency debt, but investors are closely watching how the government handles payments on its ruble bonds, known as OFZs.

Russia paid a ruble-bond coupon on Wednesday, but it’s not clear how foreign holders such as Allianz SE, BlackRock Inc. and Vanguard Group will be able to access the cash after the central bank banned transfers to foreign investors.

Technical Default

“This will likely be a technical default,” Vanguard’s Eisinger said before the payment. “We also see strong likelihood of technical default on Eurobonds at the sovereign level.”

Citi strategists also said the government might be unable to pay coupons on international debt because of possible infrastructure issues, but that they don’t expect credit-default swaps on Russian companies such as Gazprom and Lukoil to be triggered.

The world’s biggest settlement systems Euroclear and Clearstream are no longer handling Russian assets.

“There are now rising concerns over the future dynamics in Russian sovereign credit-default swaps,” Citi strategists led by Arup Ghosh, wrote in a note to investors on Friday. “The risk in our view might arise in a scenario where current restrictions are potentially extended to include a complete ban on secondary trading. That could cause significant difficulties in cash settlements.”

Latest Test

Russia may become the latest test for the credit derivatives market, which has come under scrutiny at various times since the financial crisis for failing to compensate investors for losses on underlying debt.

Citi compared Russia’s potential settlement problems to Novo Banco SA, which was left without deliverable bonds in 2016 when the Bank of Portugal decided to transfer the notes to a bad bank. That event suggested that rules introduced two years earlier to fix flaws still weren’t enough to give bondholders full protection when governments or regulators intervene.

A potential ban on secondary trading of Russian sovereign bonds could create an orphaning event similar to Novo Banco’s, whereby the derivatives become worthless because there’s no underlying debt to insure, Citi said.

“It doesn’t seem like an imminent risk yet, but investors have to be aware of the risk,” the strategists said. “In a trigger situation, the credit derivatives determination committee will have to define how universal is the inability to transfer bonds at settlement.”

Rising Concerns

Credit-default swaps on Russian sovereign debt surged this week, with protection sellers demanding payments upfront amid concerns that default risk may be imminent. Contracts insuring $10 million of the country’s bonds for five years were quoted at about $4.6 million upfront and $100,000 annually on Tuesday, ICE data show.

Outstanding contracts covered around $41 billion of Russian debt as of Feb. 11, the latest data available, according to the Depository Trust & Clearing Corp.

“Western governments’ resolve to cut off Russia from the international financial system, combined with a potentially weaker willingness on the part of the Russian government to service its debt on time and in full, raise the probability of more severe credit outcomes for foreign holders of Russian debt securities,” Moody’s Investors Service said on Tuesday.

©2022 Bloomberg L.P.