Jun 27, 2022

Russian Crude Flows Slump, But It’s Likely to Prove Temporary

, Bloomberg News

(Bloomberg) -- Russia’s seaborne crude exports plunged last week, but the drop probably doesn’t indicate that sanctions are starting to bite.

Flows from Russian ports were down week-on-week by 20%, falling to their lowest level since the week ended March 25. They are expected to bounce back though, with the dip most likely due to maintenance work at the key Baltic port of Primorsk, or the pipeline serving it.

Leaders of the G7 group of the world’s largest advanced economies are meeting in Germany to discuss, among other things, the idea of imposing a price cap on Russia’s oil exports to reduce the flow of funds to the Kremlin after its troops invaded Ukraine four months ago, while allowing the oil to keep flowing. It’s far from clear how such a mechanism could be made to work in practice.

The following charts show four-week averages of the destinations of crude shipments from Russian export terminals. With all cargoes loaded at ports on the country’s Pacific coast remaining in the region, Asia is now taking half of all the crude shipped from the country. That’s up from about one-third at the beginning of the year, but down from a peak of about 60% in late May. Shipments to India, which initially surged after European buyers shunned Russian crude, have started to slip in recent weeks, though that trend could be reversed if all the cargoes on ships with unknown destinations end up there.

Crude shipments to Asia are dominated by flows to just two countries, China and India. Seaborne cargoes headed to China are fluctuating week to week between about 1.1 million barrels a day and 730,000 barrels a day, but the four-week average has remained close to 1 million barrels a day since the start of May.

India has emerged as the savior of Russia’s crude exports, with volumes averaging more than 900,000 barrels a day in late April and early May, up from just 25,000 barrels a day at the start of the year. But flows have eased in subsequent weeks and the latest four-week average, based on loading dates, has fallen to 540,000 barrels a day.

Russia has lost almost two-thirds of its market for seaborne crude in northern Europe, but the volume it’s shipping there has stabilized following the initial drop after Russian troops attacked Ukraine.

Shipments to the region averaged less than 400,000 barrels a day in the four weeks to July 24, down from nearly 1.25 million barrels a day in the first four weeks of the year. Most countries have almost completely halted imports of Russian crude by sea, well ahead of EU sanctions on the trade that are due to come into effect in December.

A review of deliveries to Rotterdam has revealed that several ships carrying Russian crude to the port between March and early May carried out ship-to-ship transfers within the port area. As a result those cargoes have been reclassified, slashing flows to Rotterdam and boosting those to Turkey in March and subsequently to India.

Significant volumes — about 300,000 barrels a day — are still shipped to storage tanks in the Netherlands, but even this is down by 35% from the levels seen immediately before the Russian invasion of Ukraine.

The picture in the Mediterranean is very different. Shipments of Russian crude to the region have soared and remained at about 750,000 barrels a day for the past nine weeks.

A large part of the reason is the shipping of Russian crude to Russian-owned refineries in the region, particularly Lukoil’s ISAB plant on the Italian island of Sicily. Turkey has also stepped in to take a lot more Russian crude that has been diverted to the region from northern Europe.

It remains to be seen what ISAB will do when the EU ban on seaborne Russian crude comes into force in December. Until then, with no legal impediment to its purchases and few, if any alternatives to its diet of Russian crude, shipments are unlikely to fall.

The Mediterranean picture is repeated in the Black Sea, again driven by increased shipments to a Lukoil-owned refinery in Bulgaria. While flows to Romania are little changed since the start of the year, those to Bulgaria are two-and-a-half times as big as they were in January and early February. Combined shipments to Bulgaria and Romania have averaged close to 300,000 barrels a day since mid-April.

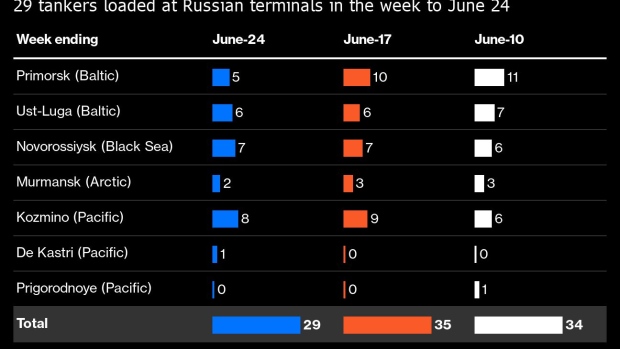

The week to June 24 saw a big drop in Russia’s seaborne crude flows, with shipments through the key Baltic port of Primorsk falling by half. A gap in planned loadings between June 21 and June 25 suggests the drop is probably due to maintenance work, either at the terminal or on the pipeline serving it, and is likely to be reversed in the coming week.

The slump at Primorsk caused total seaborne crude flows to fall sharply in the seven days to June 24, declining to their lowest level in 13 weeks. A total of 29 tankers loaded 20.9 million barrels from the country’s export terminals, vessel-tracking data and port agent reports show. That put average flows at 2.99 million barrels a day, down by 20% from 3.75 million in the week ended June 17.

Flows of Urals crude from terminals in the Baltic, Russia’s primary outlet, slumped in the week to June 24, with shipments from the Black Sea and the Arctic also down. Flows from Russia’s Pacific ports were stable, with one cargo from Sakhalin Island offsetting the one less cargo shipped from Kozmino.

Moscow’s revenue from export duty also fell by 20% in the week to June 24, shrinking in line with the flow of crude. Those shipments were worth $128 million in export duty, down from $161 million in the week to June 17.

Duty rates are set to rise in July, after falling by 10% between May and June. Crude shipments in June earn the Kremlin $44.80 a ton, equivalent to about $6.11 a barrel, a figure that will rise to $55.20 a ton (about $7.53 a barrel) in July. That will be the highest duty rate charged by the Russian government since April, reflecting an increase in Urals prices between mid-May and mid-June.

The number of cargoes shipped from Russian ports fell by six to 29 in the week to June 24 compared with the previous seven days. Shipments from Primorsk slumped to half the previous week’s level.

Crude Flows by Region

The following charts show the destinations of crude cargoes from each of the four export regions. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress.

The total volume of crude on ships loading from the Baltic terminals at Primorsk and Ust-Luga slumped in the week to June 24, falling to its lowest level since March. Shipments from Primorsk halved, with just five vessels seen loading from the terminal. This doesn’t appear to be the result of vessels going dark to remain hidden from automatic tracking systems, with the figures cross-referenced with port agent reports and traffic into and out of the Baltic.

The volume on tankers showing destinations in northern Europe rebounded from the previous week’s low, while shipments to the Mediterranean fell to the lowest in three weeks. But there was a big drop in the volume on tankers signaling destinations in Asia, which slumped to their lowest since mid-March.

One vessel that departed Ust-Luga is showing its destination as the Caribbean.

Seven tankers completed loading at Novorossiysk in the Black Sea in the week to June 24, unchanged from the previous week. But smaller cargo sizes led to a dip in the volume of crude loaded at the port. Shipments to Bulgaria and Romania rebounded from their five-week low. One ship loading at Novorossiysk in the week is indicating that it’s heading to India, while another, carrying a cargo belonging to Azerbaijan’s state oil company, Socar, appears to be heading to Haifa in Israel.

All of the cargoes scheduled from Novorossiysk during the week loaded within two days of the dates on partial loading programs seen by Bloomberg.

Shipments from floating storage units at Russia’s Arctic port of Murmansk fell in the week to June 24, dropping to their lowest since early March. Both cargoes were loaded from Gazprom Neft’s Umba floating storage unit and are headed to Rotterdam.

Crude flows from Russia’s three eastern oil terminals — Kozmino, De Kastri and Prigorodnoye — were unchanged week-on-week at 942,000 barrels a day, a level they have averaged in five out of the last six weeks.

Eight tankers loaded ESPO crude at Kozmino, down by one from the previous week. For the first time in five weeks, not all of the cargoes are headed for China. Two are on tankers heading to Sikka in India, where they’re due to arrive on July 5 and July 17.

There were no shipments for a seventh week from De Kastri, which handles Sokol crude from the Sakhalin 1 project. One of three Sovcomflot tankers that were anchored empty off the oil terminal departed and took on a cargo of ESPO crude at Kozmino. The other two remain anchored.

One cargo of Sakhalin Blend crude was loaded in the week to June 24 and was discharged at Daesan in South Korea.

Long Voyages and Cargo Transfers

Just two tankers left Russia’s western export terminals signaling destinations in India in the week to June 24. Another one is heading to China, while a further two departed showing destinations that suggest they’re heading for the Suez Canal and on to Asia. One is signaling a destination of the Caribbean and is likely to follow earlier ships that have sailed out into the Atlantic before vanishing from tracking screens.

Several tankers that loaded in earlier weeks are still not showing final destinations, with most continuing to indicate Port Said.

At least five Russian tankers heading for the mid-Atlantic have vanished from vessel-tracking systems as they approached the Azores, a tiny group of islands about 950 miles west of mainland Portugal. The Lauren II, which had previously taken on two cargoes of Russian crude from smaller ships in that area appears to have taken on a third and is now heading for Asia. That third cargo may have come from the Emily S, which reappeared on June 19 east of the Azores, as it headed back north to the Baltic after vanishing six days earlier.

Three more ships loaded with Russian crude — Skadi, Merope and Amber 6 — were heading for the Azores, or out into the Atlantic Ocean when they disappeared between June 15 and June 20.

At least 18 tankers previously identified as delivering cargoes to Rotterdam between March and early May were found to have carried out ship-to-ship transfers within the port area. As a result those cargoes have been reclassified, slashing flows to Rotterdam and boosting those to Turkey in March and subsequently to India.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: Bloomberg uses commercial ship-tracking data to monitor the movement of vessels. Ships can avoid detection by turning off on-board transponders, as has been done widely by the Iranian tanker fleet. There is no evidence yet that this is being done by crude oil tankers calling at Russian ports.

Note: Destinations are those signaled by the vessel and are monitored until the cargo is discharged. Destinations may change during a voyage, even under normal circumstances, and the final discharge point for the cargo may not be known until that port is reached.

Note: Cargo volumes are based on loading programs, where those are available, and on a combination of the ship’s capacity and its depth in the water where we have no other information.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }

©2022 Bloomberg L.P.