Jul 3, 2018

Ryan Bushell's Top Picks: July 3, 2018

Ryan Bushell, president and portfolio manager at Newhaven Asset Management Inc

Focus: Canadian dividend paying equities

_______________________________________________________________

MARKET OUTLOOK

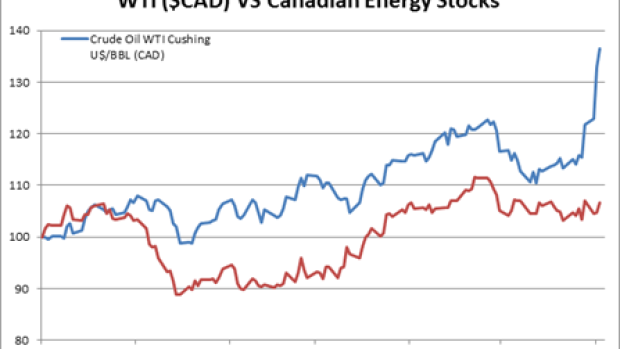

The TSX had a strong Q2 as oil prices went on a volatile ride, but ultimately finished the quarter at levels not seen since 2014. Supplies continue to tighten more than expected and the world is running out of spare capacity. Unfortunately, despite strength more recently Canadian energy stocks continue to badly lag the price of the commodity even though differentials have normalized and the Canadian dollar has weakened significantly. The following chart depicts oil prices (WTI) in Canadian dollars relative to Canadian oil producers represented by the iShares Canadian Capped Energy ETF (XEG) (source: Thomson Reuters):

Or, put another way:

Looking at the charts, you can see how much room there’s for Canadian energy stocks to perform, especially in light of the C$98 WTI environment we are in currently. I think the back half of this year will be strong for energy stocks, as demand is traditionally significantly stronger in the second half of the year and geopolitics in Iran, Venezuela and Libya are not likely to improve. Financials, the other heavyweight in the TSX, are down year-to-date despite a favourable interest rate environment and rising earnings. Fears about Canadian housing and the consumer abound, but employment remains strong. Wealth management is booming and net interest margins are expanding. Long-term yields have remained fairly well contained, which has hurt the life insurers. But with inflation likely to pick up and employment remaining strong, you could see 10-year U.S treasuries trade through a 3.5 per cent yield in the second half of the year, which should improve sentiment. Add the positives for these two sectors together, combine it with some positive pipeline news and you get a pretty strong case for the TSX to move materially higher in the second half following a sluggish start to the year. This is very similar to what we saw in 2016, when the TSX returned over 20 per cent including dividends.

Instead, much of the market’s focus seems to be on cannabis, which is one sector I would be avoiding at present. This has all the makings of a classic bubble, especially the part where people with no ongoing interest in the stock market are opening trading accounts in droves. The four largest cannabis companies have a combined market capitalization of $19 billion. This is exactly the same size as one of my longest-tenured holdings, Fortis, which is a public utility provider in Canada and the U.S. Let’s compare and contrast the two:

| FACTOR | FORTIS | AURORA, CANOPY, APHRIA, MEDRELEAF |

|---|---|---|

| Years in business | 137 | Less than 20 combined |

| Revenue (last 12 months) | $6.5 billion | $150 million combined |

| Operating cash flow | $2.2 billion | -$78 million combined |

| EBITDA | $2.9 billion | -$114 million combined |

| Balance sheet assets (reported) | $38 billion | Around $2 billion |

| Book value/share | $28.50 | Around $4 (average) |

Remember these companies have the same market valuation. I know which one I’d rather own. The last time I felt this way was when Valeant Pharma overtook Royal Bank as the largest stock in Canada in August of 2015. 10 months later, Valeant had lost more than 90 per cent of its value. I will stick my neck out and say that, if you buy a share of all four of these stocks today, you will lose money in five years. Maybe a lot of money; the numbers don’t add up.

TOP PICKS

MANULIFE (MFC.TO)

Most recent purchase at $23.60.

Manulife has not performed recently as 10-year benchmark yields retreated following a surprise result in the Italian election. With oil prices rising, employment remaining strong and the Fed and Bank of Canada poised to keep increasing interest rates, I think sentiment toward Manulife will improve in the back half of 2018. Longer term, I like the tact that the new management team is taking and am very positive on their wealth management business as the baby boom generation transitions to spending from their portfolios in retirement. The company now has the same yield as Sun Life and is growing their dividend at a faster rate. This is one of the few companies where we’re adding full positions presently.

ARC RESOURCES (ARX.TO)

Most recent purchase at $13.50.

While ARC Resources is typically seen as a natural gas producer by the market, they’re much more levered to oil (more than 60 per cent) and oil prices in terms of revenue at present and have negligible Alberta natural gas pricing exposure (less than 5 per cent for 2018). ARC has a disciplined management team and an unparalleled land position which will fuel the company for decades to come. The balance sheet is reasonable at less than two times debt to cash flow and the stock yields over 4.2 per cent currently. Going forward, the natural gas supply picture is clearing up as Western Canadian producers are curtailing supply and the combination of a cold spring switching almost immediately to a hotter than normal summer is keeping storage injections much more moderate than feared. Longer term, I expect Shell and their partners to build LNG Canada in Kitimat, which will provide a much needed relief valve for Montney gas and stabilize pricing for Canadian producers.

SCOTIABANK (BNS.TO)

Most recent purchase at $74.40.

Although I don’t love the most recent purchases in the wealth management space, Scotiabank is trading too cheaply to ignore. The company yields over 4 per cent and as stated earlier the banking environment continues to look favourable in Canada. With the very recent run in pipelines and energy, financial stand out as unfairly cheap and Scotiabank is the cheapest of the bunch. I would hold my nose and buy some here despite the negative sentiment, as the fundamentals are solid and its trading at such a discount to the others in terms of yield and price-to-earnings.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| MFC | Y | Y | Y |

| ARX | Y | Y | Y |

| BNS | Y | Y | Y |

PAST PICKS: JUNE 27, 2017

VERMILION ENERGY (VET.TO)

Vermilion recently completed an extremely accretive acquisition of Spartan Energy that looks very good in the current $70 WTI environment with a Canadian dollar trading at $0.75. Vermillion is internationally diversified and pays nearly a 6 per cent dividend yield that they have never cut. The company continues to be a core holding of all my clients.

- Then: $42.05

- Now: $47.19

- Return: 12%

- Total return: 20%

TD BANK (TD.TO)

I continue to recommend TD Bank even though the share price is $10 higher than last year. Worries surrounding Canadian housing continue to suppress valuations and, although the concerns should not be ignored, any fallout should be manageable in the context of the bank’s diversified revenue streams. Additionally, offsetting positive impacts like increasing net interest margins and wealth management revenues should persist as rates rise. If you are worried about the Canadian consumer, TD is your best bet as over half their retail bank is now in the U.S., where revenues are up about 5 per cent this quarter on currency translation alone. TD has the best dividend growth rate in the group (outside of CIBC, where they’re increasing their payout ratio deliberately). Although it’s a bit boring, I think TD will be a strong performer in the back half of 2018 and beyond.

- Then: $65.26

- Now: $75.83

- Return: 16%

- Total return: 20%

ENBRIDGE (ENB.TO)

The move down in Enbridge has been surprising and not well founded in my view. Concerns surrounding the complex structure were valid, but the company is taking steps to clean this up as I expected. Recent equity issuance combined with planned and already executed asset sales has shored up the balance sheet and funding plan while term interest rates remain contained. I think you will see investors start to come home to the company that’s sporting an over 6 per cent dividend yield, especially if concerns around Line 3 abate following the court decision last week and the ensuing short cover.

- Then: $52.75

- Now: $46.10

- Return: -13%

- Total return: -7%

Total Return Average: 11%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| VET | Y | Y | Y |

| TD | Y | Y | Y |

| ENB | Y | Y | Y |

WEBSITE: www.newhavenam.com

LINKEDIN: Ryan Bushell