Oct 20, 2021

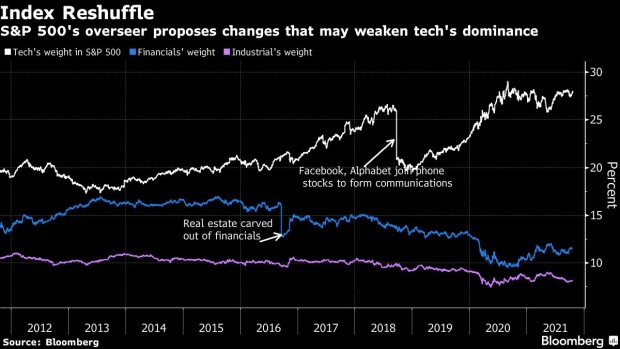

S&P 500 Shake-Up Opens Path to Shrinking Tech’s 28% Dominance

, Bloomberg News

(Bloomberg) -- The huge technology group in the S&P 500 could become smaller next year should Visa Inc., PayPal Holdings Inc. and Mastercard Inc. join the financial sector.

So says Todd Rosenbluth, head of ETF and mutual-fund research at CFRA. With S&P Dow Jones Indices proposing changes to regroup stocks, he also anticipates payment-services providers Automatic Data Processing Inc. and Fidelity National Information Services Inc. to exit tech and become part of the industrial segment.

If implemented, the changes could weaken tech’s share in the S&P 500, which has swollen to 28% -- topping the combined weights of the health-care and consumer-discretionary groups. Financials, the fourth-biggest industry, could then have a shot at becoming the No. 2 with the new additions, according to data compiled by Bloomberg.

This “could shake up three of the largest U.S. sectors,” Rosenbluth wrote in a note to clients. “We expect the changes to occur in 2022.”

Such a move would also make money managers at index and exchange-traded funds reshuffle their positions to mimic the changes. ETFs focused on technology, financial and industrial shares currently oversee $310 billion of assets, data compiled by Bloomberg Intelligence show.

The proposed revision is part of a consultation paper on the global industry classification standard that S&P announced earlier this week in conjunction with MSCI. The consultation ends on Dec. 20 -- with any changes to the GICS structure to be announced by February 2022.

©2021 Bloomberg L.P.