Mar 31, 2023

S&P Lowers Outlook for Turkey’s Debt Rating to Negative

, Bloomberg News

(Bloomberg) -- S&P Global Ratings lowered its outlook for Turkey’s sovereign credit rating to negative from stable, citing a series of challenges including earthquake-recovery costs and uncontrolled inflation.

The rating company affirmed its B rating for Turkey, leaving it on par with Egypt and Kenya.

While last year’s central government deficit was low, “other broader public sector risks are increasing,” S&P Global said in its statement published on Friday after markets closed in New York.

Reconstruction in the aftermath of a series of earthquakes that shook the country’s southeast in February, killing around 50,000 people, will require internal and external financing of as much as 12% of gross domestic product, S&P said.

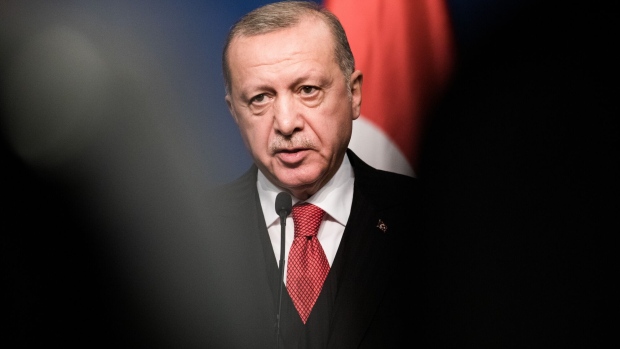

President Recep Tayyip Erdogan is pursuing an unorthodox policy to keep the economy growing ahead of elections on May 14, where he is seeking a third term in office.

The Turkish central bank cut the key policy rate to 8.5% in February even though annual consumer inflation is hovering around 55%, compared with its official target of 5%. The Turkish lira lost around a quarter of its value against the US dollar over the past year, the second biggest drop after Argentina among 23 major currencies tracked by Bloomberg.

“Unrestrained inflation complicates our fiscal, economic and monetary analysis,” S&P wrote.

It also cited concerns about the central bank and treasury’s commitments to compensate depositors for any exchange rate-related losses on foreign currency-linked savings. Those savings are equal to about 9.3% of GDP, S&P said.

S&P last downgraded Turkey’s credit rating in September, citing concerns over the country’s ultra-loose monetary policy.

The country’s credit rating was downgraded by the other two major agencies in the past nine months. Moody’s Investors Service cut the country’s rating in August to B3, citing balance-of-payments risks, while Fitch Ratings downgraded Turkey’s sovereign debt to B in July on inflation worries.

--With assistance from Jim Silver.

©2023 Bloomberg L.P.