New US Home Sales Jump to Highest Level Since September

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

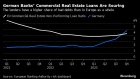

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Mar 22, 2021

, Bloomberg News

Sales of previously owned U.S. homes declined in February to a six-month low, reflecting a record annual decline in the number of available properties that’s driving up prices and impeding buyers.

Contract closings decreased 6.6 per cent from the prior month to an annualized 6.22 million from a downwardly revised 6.66 million in January, according to National Association of Realtors data released Monday. The median forecast in a Bloomberg survey of economists called for a 6.49 million rate.

Higher asking prices, tied in part to a limited number of homes on the market, and rising mortgage rates are reducing affordability in the lead up to the busy spring selling season. At the same time, demand is up 9.1 per cent from a year ago and indicates sales will probably hold up as the economy strengthens and employment improves.

“The fact that even with the decline in sales, days on the market is swift, prices are rising strongly -- it’s implying that demand isn’t disappearing from the marketplace,” Lawrence Yun, NAR’s chief economist, said on a call with reporters. “It really is a lack of supply.”

The number of homes for sale declined by a record 29.5 per cent in February from a year ago, helping explain a 15.8 per cent jump in the median selling price to $313,000. That was the highest-ever median price for that month.

Lean Inventory

Housing inventory in February was 1.03 million units. At the current pace, it would take 2 months to sell all the homes on the market, compared with 3.1 months last February. Anything below five months of supply is a sign of a tight market.

Purchases of all existing homes fell in three regions, including in the South and Midwest, where the month’s weather impacts were the most severe. In the South, contract closings declined 6.1 per cent to an annualized 2.77 million, the slowest pace in five months.

They dropped 14.4 per cent in the Midwest to a 1.31 million rate, the weakest since June. Home sales fell 11.5 per cent in the Northeast and rose 4.6 per cent in West.

Assuming the 30-year mortgage rate remains below 4 per cent, damage to affordability shouldn’t be not severe enough to halt strong momentum in the housing sector in 2021, according to an analysis from Bloomberg Economics. Yun says he expects 30-year fixed rates to rise to 3.5 per cent by the end of the year.

Digging Deeper