Jan 23, 2023

Salesforce Job Cuts, Big Deals at Stake as Elliott Pushes for Profit

, Bloomberg News

(Bloomberg) -- Salesforce Inc. will probably be urged by activist investors Elliott Investment Management and Starboard Value to cut more jobs, make changes to the board and spin off big acquisitions in search of greater profit, Wall Street analysts said.

The company, the top maker of customer relations software, has been struggling with slowing growth, executive departures and investor pressure. The shares have lost half their value since a late 2021 peak, and were in the bottom 10th of S&P 500 stocks last year.

Investors greeted the news Sunday that Elliott had taken a multibillion-dollar stake by sending shares climbing as much as 5.9% Tuesday morning to $160.21. The stock has now recouped most of its losses since co-Chief Executive Officer Bret Taylor’s departure was announced on Nov. 30.

Salesforce said earlier in January that it would eliminate about 10% of its workforce, which had increased more than 60% in almost three years to about 80,000 employees by the end of October 2022. Some of that growth came from multiple acquisitions, including the 2021 takeover of business chat application Slack for more than $27 billion. Elliott’s presence as an activist investor reduces concerns that co-founder Marc Benioff might make impulsive mergers to invigorate growth as the sole CEO in the wake of Taylor’s exit, wrote Jordan Klein, an analyst at Mizuho Securities.

Activist investors often push for strategic changes and board representation. Salesforce’s directors are particularly vulnerable to shareholder activism since each member is up for reelection this year, and four non-founders have been on the board for more than 15 years, wrote Patrick Walravens, an analyst at JMP Securities. Discussions over potential board candidates are likely to move quickly, because the current nomination window begins in three weeks.

While it has pushed for new CEOs at other companies, Jesse Cohn, managing partner at Paul Singer’s Elliott, said the firm has developed a “deep respect” for Benioff. “It’s a level of support you don’t always see when Elliott discloses a position, which suggests they won’t push for his replacement,” said Victoria Sivrais, senior managing director at Clermont Partners, an investor relations and communications firm. She added that doesn’t mean others on the executive team are safe.

Elliott is one of several activists seeking changes at Salesforce. Starboard Value announced a stake in October, saying the company was falling behind peers due to issues with translating growth into profitability. Jeff Ubben’s Inclusive Capital also is a shareholder, CNBC reported earlier.

Elliott and Starboard have tried to simultaneously influence companies before. In 2019, each invested in EBay Inc. and helped force out the CEO, appoint new board members, and spin off the StubHub ticketing unit. The two are known as some of the most involved activist investors, said Gregory Rice, who co-leads the shareholder advisory and activism effort at Boston Consulting Group.

With both activists pushing for better operating margins, Salesforce may go through “multiple iterations of headcount reductions or restructuring,” said Derrick Wood, an analyst at Cowen & Co. He added that Elliott may have been in conversations with management during the 10% cuts announced earlier, citing similar discussions before the investment firm announced a stake in SAP SE in 2019.

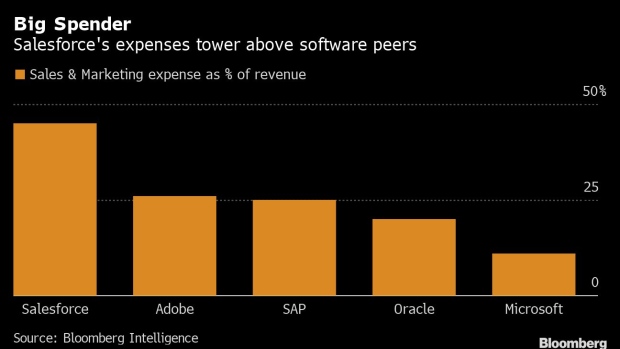

Salesforce’s sales and marketing budget is high for the industry and symbolized by massive events like its annual Dreamforce conference. Its expenditures as a share of revenue are well above peers such as Adobe Inc. or Microsoft Corp., according to data compiled by Bloomberg Intelligence. An operating margin focus means that major acquisitions are likely off the table in the near term, as past deals for Slack, Tableau and Mulesoft dented Salesforce’s margins, said Bloomberg Intelligence’s Anurag Rana.

Activists may propose spinning off past acquisitions, said Rishi Jaluria, an analyst at RBC Capital Markets. Divesting Slack could be margin-boosting, though would likely have to be sold for less than Salesforce paid, he said. Mulesoft, which is now probably worth more than the $6.5 billion acquisition cost, could be divested without disrupting the company’s core cloud products, he added.

“This is a critical juncture for Salesforce,” Jaluria said. If they maintain cost discipline and make the right changes, “we could see a stronger company exiting the recession and see 30%-plus margins.”

(Updates shares in third paragraph)

©2023 Bloomberg L.P.