Jan 29, 2020

Samsung misses estimates as memory chip prices continue slide

, Bloomberg News

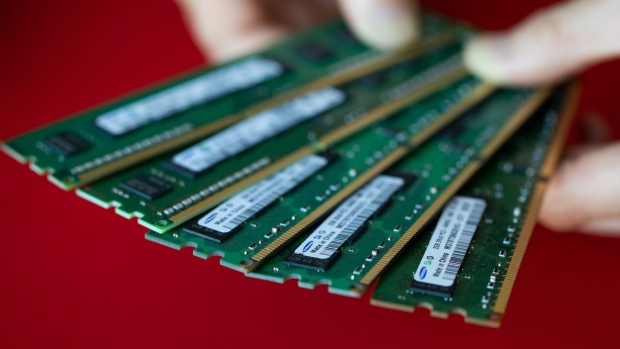

Samsung Electronics Co. reported a 38% decline in profit as memory chip prices continued to decline and weak demand hit the display business.

Net income came in at 5.23 trillion won (US$4.4 billion) for the three months ended December, compared with the 5.31 trillion won average of projections. Samsung reported preliminary numbers earlier this month that showed operating profit fell by 34%.

Samsung has been struggling with a stubborn slump in its memory chip business, historically its most profitable division, although the company said there are signs of recovering demand from data center customers and wireless operators. The company also flagged weak demand in the display business for some premium mobile screens and a bigger loss on large displays because of sliding LCD prices.

”Memory-chip suppliers still have a high level of inventories,” said Lee Joo-wan, research fellow at Hana Institute of Finance. “As the first half of the year is off-season, it may take time for recovering prices to be reflected in the performance of suppliers.”

Samsung shares fell as much as 2% in Seoul. They had increased 5.9% this year through Wednesday, after rising about 44% in 2019. Operating profit was 7.16 trillion won on sales of 59.9 trillion won, the company said, in line with preliminary numbers released earlier this month.

Samsung, SK Hynix Inc. and Micron Technology Inc. together control more than 90% of the market for dynamic random access memory, or DRAM, chips, used in everything from data servers to smartphones. Spot prices of DRAM and NAND started increasing in December after getting hammered for a year amid rising trade tensions between the U.S. and China as well as plateauing smartphone sales. The chip industry has been anticipating a recovery as the roll-out of fifth-generation wireless technology spurs higher demand for memory and greater speeds to process data.

“In the first quarter of 2020, overall DRAM demand is seen softening on seasonal effects, although some purchases for mobile and server applications will remain relatively solid,” the company said in its statement.

Contract prices for 32-gigabyte DRAM server modules fell about 5.9% in the December quarter, narrower than the 14% slide of the September quarter, according to InSpectrum Tech Inc. Prices for 128-Gb MLC NAND flash memory chips held steady in the final three months of 2019.

Samsung’s smartphone division posted 2.52 trillion won in operating income, up from 1.51 trillion won a year earlier. Although the total shipments of smartphones slightly decreased, high-end devices such as the Galaxy Note 10 and Galaxy Fold boosted profits in the fourth quarter. Samsung’s new clamshell-type foldable phone, which will be unveiled Feb. 11, is expected to further fuel its long-term growth momentum, said Greg Roh, senior vice president at HMC Securities.

Samsung’s operating profit from its display business was about 220 billion won, down from about 970 billion won a year earlier. The company is investing heavily in flexible organic light-emitting diode panels, shifting from LCDs amid competition from Chinese suppliers such as BOE Technology Group Co.

The consumer electronics unit, which includes TVs and appliances, had operating profit of about 810 billion won.