Jan 30, 2023

Samsung Profit Plunges as Memory Chip Crash Eats Into Earnings

, Bloomberg News

(Bloomberg) -- Samsung Electronics Co. made a surprisingly aggressive decision to keep capital spending at the same level as last year, defying expectations that it go along with rivals in pulling back to alleviate pressure on an already-battered semiconductor industry.

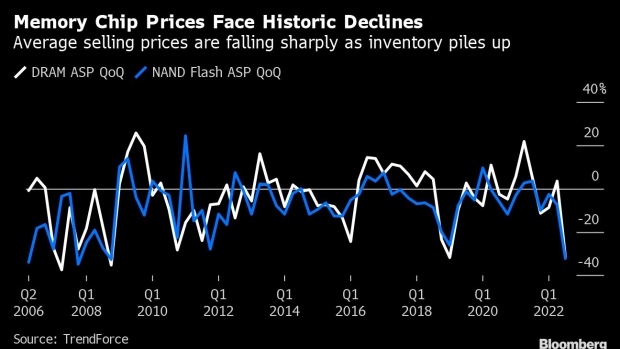

Chipmakers have been struggling with a historic slump in the price of memory, with consumers cutting back on purchases of gadgets months after pandemic-driven production ramp-ups kicked in. Inventory has piled up, forcing double-digit price slides that are erasing profit and forcing Samsung’s smaller competitors to slash both output and spending.

Samsung warned that it expected a recovery in chips to begin only in the second half of the year, while smartphone demand would likely contract in 2023. But despite pressure on the world’s largest memory chipmaker to slow down spending on new capacity, the company said it would keep on spending on chips, which last year came to 47.9 trillion won ($39 billion). The result will be more pressure on chip pricing than if the Korean giant had pulled back spending on new machinery and factory capacity.

“Markets were getting ahead of themselves and expected a cut,” said An Hyungjin, chief executive officer at Billionfold Asset Management, adding that Samsung’s move to stick to its pace in spending will hit other smaller chip rivals.

Shares of Samsung, which supplies displays and semiconductors used in Apple Inc.’s iPhones, shed 3.6% Tuesday in their biggest decline in three months. South Korean rival SK Hynix Inc. ended down 2.4%.

Samsung’s plan to keep spending into the downturn will likely widen the company’s lead over smaller rivals who are scaling back, but at the cost of profitability.

Samsung’s smaller rivals have almost universally hit the brakes on spending. US memory maker Micron Technology Inc. has said it will cut spending for new plants and equipment as well as slash output. Hynix has also scaled back investments and output, while Japan’s Kioxia Holdings Corp. has said it was cutting output by 30%. Kioxia, which makes NAND, is in merger talks with US production partner Western Digital Corp., Bloomberg News reported.

Chip price declines are already eating away at Samsung earnings. Profit at the key chip segment plunged 97% to 270 billion won in the three months ended December, as customers continued to work through piles of inventories. Operating profit fell 69% to 4.3 trillion won in the biggest drop in over a decade in line with the company’s preliminary results earlier this month.

Net income more than doubled to 23.5 trillion won, thanks to a one-time item from a local tax law change that won’t mean a refund.

Samsung said gadgets with more storage would drive recovery in the second half of the year, but it warned that in the current quarter, earnings would likely decline and factory usage rates in its contract chipmaking business would fall.

While noting that the business environment “deteriorated significantly in the fourth quarter,” Jaejune Kim, executive vice president in charge of the company’s memory division, said the company’s stance on chip spending remained unchanged.

“Our capex approach this year is to continue to make the infrastructure investments that are necessary to respond to mid to long-term demand,” he said during an earnings call. “Therefore, this year’s capex plan is expected to be similar to the previous year.”

Kim did say the company’s line optimization and equipment layout adjustments would “inevitably” impact supply, signaling the pace of memory production would slow in coming months.

Artificial intelligence chatbot services — such as OpenAI Inc.’s ChatGPT — would likely stir new demand for memory chips, as well as for high-performance CPUs that generative AI requires, executives said.

A recovery in demand from clients will be key, said Jeff Kim, head of KB Securities’ research center.

“At this point, the most important factor for the memory sentiment is when clients finish digesting inventory,” he said.

--With assistance from Youkyung Lee and Sam Kim.

(Updates with closing share price, details from fifth paragraph)

©2023 Bloomberg L.P.