Jan 7, 2019

Samsung's 'shock' profit estimate miss fails to drag shares

, Bloomberg News

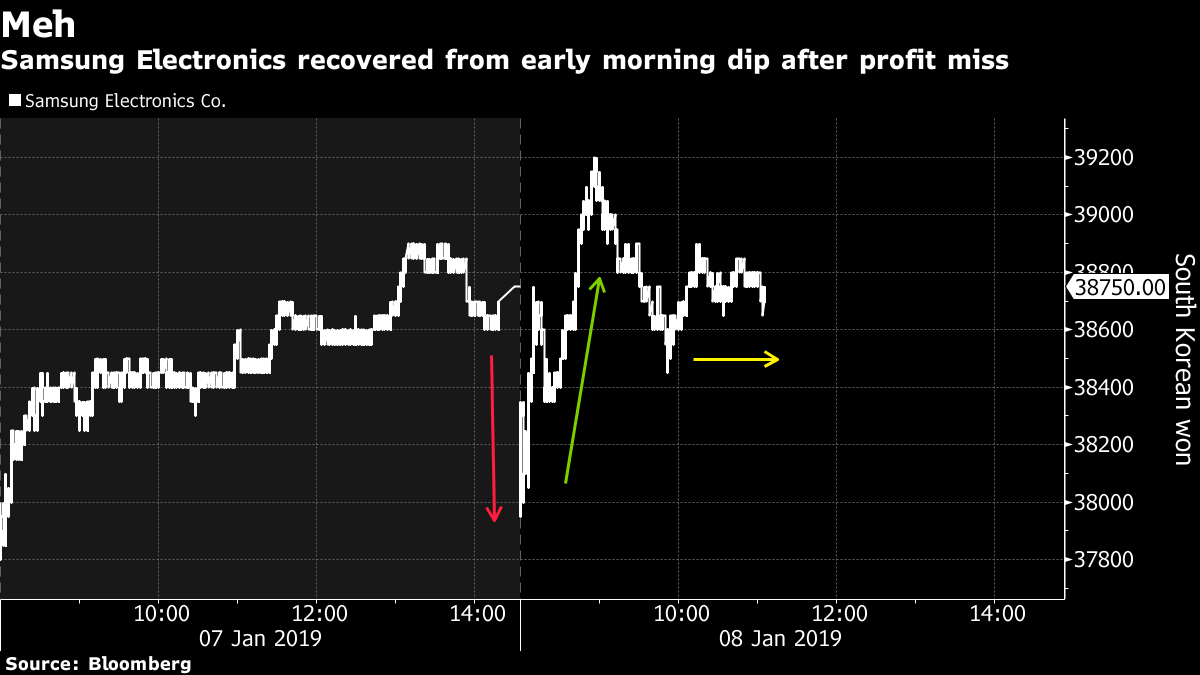

Samsung Electronics Co. (SSNGY.PK) shares recovered from a dip as analysts say the December stock-rout had priced in today’s disappointing fourth-quarter earnings estimates.

The stock fell as much as 2.1 per cent only to erase that loss and climb 1.2 per cent, with some analysts saying the bleak results on slumping chip demand have largely been factored in. The stock was little changed as of 12:16 p.m. in Seoul. The South Korean company reported preliminary operating income dropped to 10.8 trillion won (US$9.65 billion) for the period that ended in December, missing the average analyst estimate compiled by Bloomberg by 22 per cent.

Samsung shares lost 24 per cent last year, capping its worst performance since 2000, as the stock took a beating from sliding chip prices and a slowdown in fresh smartphone demand. The world’s largest smartphone maker by shipment has been increasingly dependent on chips for profit growth, riding on a spike in global data traffic while yielding to stiffer competition for phones.

Semiconductors currently account for more than three-quarters of Samsung’s total profit, compared with the first quarter of 2013 when its phone business represented almost three-quarters of profit.

Here’s what analysts said:

BNK Securities (Park Sung-soon)

- “The results were a bit worse than expected but it’s not as if we were expecting good results in the first place.”

- “There was a bout of estimate downgrades by brokerages in December and the stock price had slumped.”

- “The most important thing from here is for the pace of decline in chip prices to slow, which I expect will happen in the second quarter.”

HI Investment & Securities (Song Myung-sup)

- “It’s a shock.”

- “It’s not just Apple, but also smartphone, server and PC manufacturers that are not buying.”

- “While the U.S.-China trade war hangs over them, these customers just won’t accept current prices, and Samsung faces pressure to cut chip prices.”

Eugene Investment & Securities Co. (Lee Seung-woo)

- “The trajectory of the memory downturn is increasingly turning unwholesome,” according to a note dated Jan. 3

- “The reality is that the semiconductor industry is still under a thick cloud with no clear outlook.”

--With assistance from Amanda Wang