Jul 18, 2019

SAP’s Cloud Growth Stumbles as Push for Profitability Stalls

, Bloomberg News

(Bloomberg) -- SAP SE’s $10 billion bet on its cloud business hit a bump after order entry slowed in the second quarter and a push to improve profit margins failed to make progress.

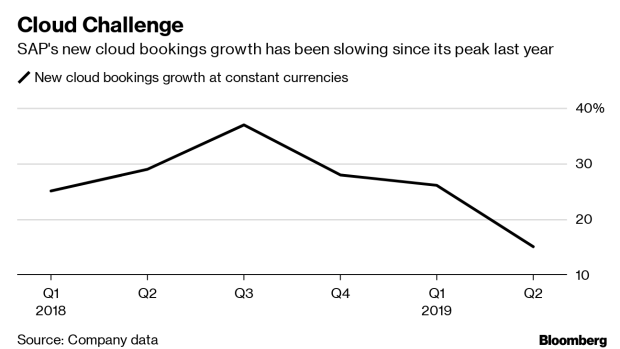

The decrease in growth in new cloud bookings, a keenly watched metric because it indicates future revenue, underscores the difficult transition to internet-based software as Chief Executive Officer Bill McDermott challenges rivals such as Salesforce.com Inc. and Oracle Corp.

The stock fell as much as 10% in Frankfurt trading, the steepest intraday plunge in nearly four years. It declined 6.3% as of 9:57 a.m. local time.

Cloud sales can initially be less profitable than traditional on-premise installations, and while the company has pledged to increase its non-IFRS operating margin by 1 percentage point a year on average through 2023, profitability was flat in the second quarter. SAP cited acquisition costs and delayed software spending in Asia because of trade uncertainty.

SAP’s second-quarter performance was “underwhelming,” Citi analyst Walter H. Pritchard said in a note to clients, citing “light” cloud bookings and disappointing margins.

SAP’s new cloud bookings rose 15% at constant currencies, a drop from the 26% gain in the first three months of 2019. The lower cloud bookings figure is due to the fact that SAP is focusing on higher-margin sales, and that more customers chose “pay as you go” products that aren’t counted toward that metric, Chief Financial Officer Luka Mucic said. Excluding infrastructure-as-a-service, growth would be 27%, he said.

“We’re exactly on track in what we need to hit our mid-term objectives to triple our cloud revenue by 2023,” he said in an interview with Bloomberg TV. “Also the profitability in the cloud is steeply increasing.”

Walldorf, Germany-based SAP spent more than $10 billion to buy U.S. cloud startups Qualtrics International Inc. and Callidus Software Inc. to bolster its portfolio. The Qualtrics acquisition will prove to be a “growth catalyst,” McDermott said in a telephone interview. “There’s plenty of room to continue strong cloud bookings and cloud growth.”

Total sales rose 11% to about 6.7 billion euros ($7.5 billion), boosted by strong growth from existing cloud customers, with revenue for the segment jumping 40%. The profit margin was flat at 27.3%.

Uptake of SAP’s flagship S/4 Hana software accelerated in the April-June period, with the company adding about 600 customers for a total of more than 11,500 users. The software allows businesses to run tasks on their own machines or in a cloud-computing arrangement hosted by SAP or one of its partners.

SAP stuck to its outlook for operating profit to rise at least 9.5% and cloud revenue to increase more than 33%.

(Updates with analyst comment in fifth paragraph.)

To contact the reporter on this story: Stefan Nicola in Berlin at snicola2@bloomberg.net

To contact the editors responsible for this story: Giles Turner at gturner35@bloomberg.net, Chris Reiter, Iain Rogers

©2019 Bloomberg L.P.