Aug 17, 2021

Saudi Activision Blizzard stake rises again amid controversy

, Bloomberg News

Kim Bolton discusses Activision Blizzard

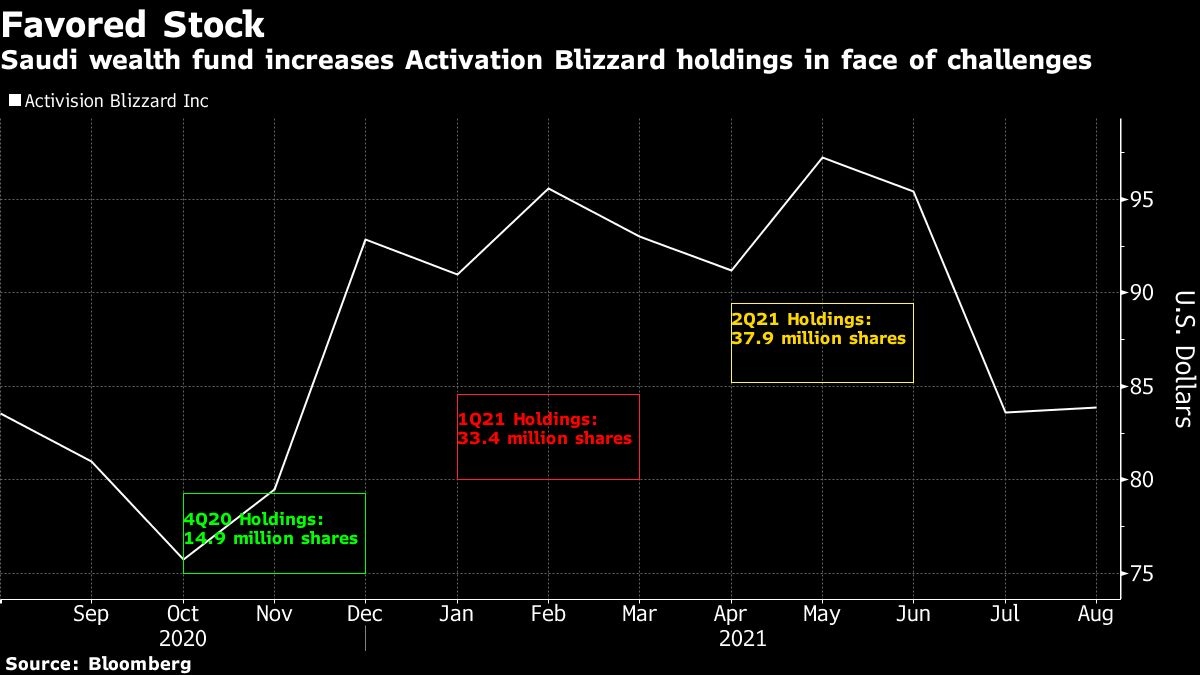

Saudi Arabia’s sovereign wealth fund kept buying Activision Blizzard Inc.’s stock last quarter, a commitment that may be tested as the video-game giant contends with a legal challenge over harassment and sexism in the workplace.

The Public Investment Fund raised its holding in the maker of popular games like World of Warcraft by 13 per cent to 37.9 million shares, with a market value of US$3.6 billion, according to a regulatory filing. The sovereign investor, known as the PIF, has now more than doubled its stake since the fourth quarter and owns 4.9 per cent in the company.

The stock ended the second quarter down 8 per cent from its peak in mid-February. It’s lost nearly 10 per cent so far this year.

Chaired by Crown Prince Mohammed bin Salman, the fund started investing in U.S. video-game makers at the end of last year, when it bought more than US$3 billion worth of stock in Activision Blizzard, Electronics Arts Inc., and Take-Two Interactive Software Inc.

The crown prince has long been a fan of video games, saying in 2018 that his favorite diversion is Call of Duty series, Activision’s best-selling franchise. His charitable organization owns one-third of Japanese games maker SNK Corp. and says it wants to increase its stake to 51 per cent in the future.

But the industry hasn’t fared well lately, as the surge in play during the onset of the COVID-19 pandemic last year slows down.

Activision, the largest independent U.S. game maker, is also facing a legal challenge to the so-called bro culture in games. Last month, Activision was sued by a California state agency, which alleged women at the company were subjected to constant harassment, unequal pay and retaliation.

An Activision investor is also suing the company for not initially disclosing the the ongoing state investigation.

The company, based in Santa Monica, California, has said it’s taking steps to improve the workplace environment.

Since 2015, the PIF’s assets under management have risen to US$430 billion from about US$150 billion. It has taken stakes in Uber Technologies Inc., put US$45 billion into SoftBank’s Vision Fund, and backed electric vehicle maker Lucid Motors Inc. Managed by Governor Yasir Al Rumayyan, the fund has outlined a plan to grow its assets to over 4 trillion riyals (US$1.1 trillion) by 2025.

Apart from Activision Blizzard, the PIF’s other top shareholdings were unchanged in the second quarter. The sovereign wealth fund’s disclosed holdings rose 3.2 per cent in value during the period to US$15.9 billion. The S&P 500 Index advanced 5.8 per cent.